Have you ever thought about how the delicate balance of an intricate web keeps everything in a garden connected?

Similarly, Friedrich Hayek’s price theory acts as the invisible thread that weaves together the complex fabric of economic policy. Hayek, a renowned economist of the Austrian School, believed that the market, like a self-organizing ecosystem, possesses the ability to allocate resources efficiently through the price mechanism.

In this introduction, we will explore how Hayek’s price theory shapes economic policy, guiding us towards innovation and progress. By understanding the role of prices in conveying information, reflecting scarcity, and promoting market efficiency, we can appreciate the influence of Hayek’s ideas on economic policies that strive to balance individual liberty and collective welfare.

However, it is important to acknowledge the challenges and criticisms that exist, as we navigate the ever-evolving landscape of economic theory and practice.

Key Takeaways

- Spontaneous order challenges the traditional view of centrally planned economic systems and highlights the power of individual actions and the self-regulating nature of markets.

- Prices serve as signals in the market, conveying information about the scarcity and desirability of goods and services, and guide the allocation of resources towards goods and services that are most valued by consumers.

- Market efficiency relies on market signals and information, which guide economic decisions and shape policies, and the decentralized decision-making based on market signals harnesses the collective wisdom and knowledge of individuals.

- Hayek’s critique of central planning argues that a centralized authority cannot efficiently allocate resources without the guidance of market signals, and embracing market-based mechanisms allows for flexibility, adaptation, and overall welfare improvement.

The Concept of Spontaneous Order

In our understanding of Hayek’s Price Theory and its impact on economic policy, we recognize the significant role of the concept of spontaneous order. Spontaneous order refers to the emergence of complex and coordinated patterns of behavior through unplanned coordination among individuals. This concept is crucial in understanding how markets function and how economic systems can efficiently allocate resources.

Spontaneous order dynamics are at the core of Hayek’s Price Theory. Hayek argued that markets aren’t the result of deliberate design or central planning, but rather the outcome of countless individual actions and interactions. Through the process of unplanned coordination, individuals respond to changes in prices and make decisions based on their own knowledge and preferences. This decentralized decision-making process leads to the emergence of a spontaneous order, where resources are allocated efficiently and goods and services are produced to meet market demand.

The concept of spontaneous order challenges the traditional view that economic systems need to be centrally planned and controlled. It highlights the power of individual actions and the self-regulating nature of markets. By recognizing the importance of spontaneous order, policymakers can embrace a more open and innovative approach to economic policy, allowing markets to function and adapt organically.

Understanding the concept of spontaneous order sets the stage for exploring the role of prices in allocating resources. Prices play a critical role in conveying information and coordinating economic activity. By examining the relationship between prices and resource allocation, we can further understand the mechanisms that drive market dynamics and shape economic outcomes.

Role of Prices in Allocating Resources

To understand how prices allocate resources, we need to examine their role in coordinating economic activity. Prices serve as signals in the market, conveying information about the scarcity and desirability of goods and services. They play a crucial role in determining the allocation of resources in an economy.

Here are two key aspects of how prices allocate resources:

- Market Equilibrium:

- Prices help in achieving market equilibrium, where the quantity demanded by consumers equals the quantity supplied by producers. When prices are too low, it signals that the good or service is in high demand, prompting producers to increase supply. Conversely, when prices are too high, it indicates that the good or service is in low demand, leading producers to reduce supply. Through this feedback mechanism, prices guide the allocation of resources towards goods and services that are most valued by consumers.

- Price Elasticity:

- Price elasticity measures how responsive the quantity demanded or supplied is to changes in price. When goods or services have high price elasticity, small changes in price lead to significant changes in demand or supply. This information is crucial for resource allocation. If a good has high price elasticity of demand, a decrease in price would likely lead to a large increase in demand, which would require reallocating more resources towards its production.

Market Signals and Information

We rely on market signals and information to guide our economic decisions and shape our policies. The concept of market efficiency plays a critical role in this process. Market efficiency refers to the ability of markets to incorporate and reflect all available information in the prices of goods and services. It’s through the interaction of buyers and sellers that prices are determined, and these prices serve as signals that convey valuable information about supply and demand conditions in the economy.

Price discovery is another important aspect of market signals and information. It refers to the process by which prices are established in the market through the forces of supply and demand. As buyers and sellers interact, they negotiate and adjust prices based on their assessments of the value of goods and services. This continuous process of price discovery allows market participants to make informed decisions about the allocation of resources.

By relying on market signals and information, we can harness the collective wisdom and knowledge of millions of individuals. This decentralized approach to decision-making allows for flexibility and adaptation to changing economic conditions. It enables us to respond more effectively to market dynamics and allocate resources efficiently.

Transitioning into Hayek’s critique of central planning, we must recognize that market signals and information can’t be replicated by a centralized authority. Hayek argued that the complexity of the economy and the dispersed nature of knowledge make it impossible for a central planner to efficiently allocate resources without the guidance of market signals.

Hayek’s Critique of Central Planning

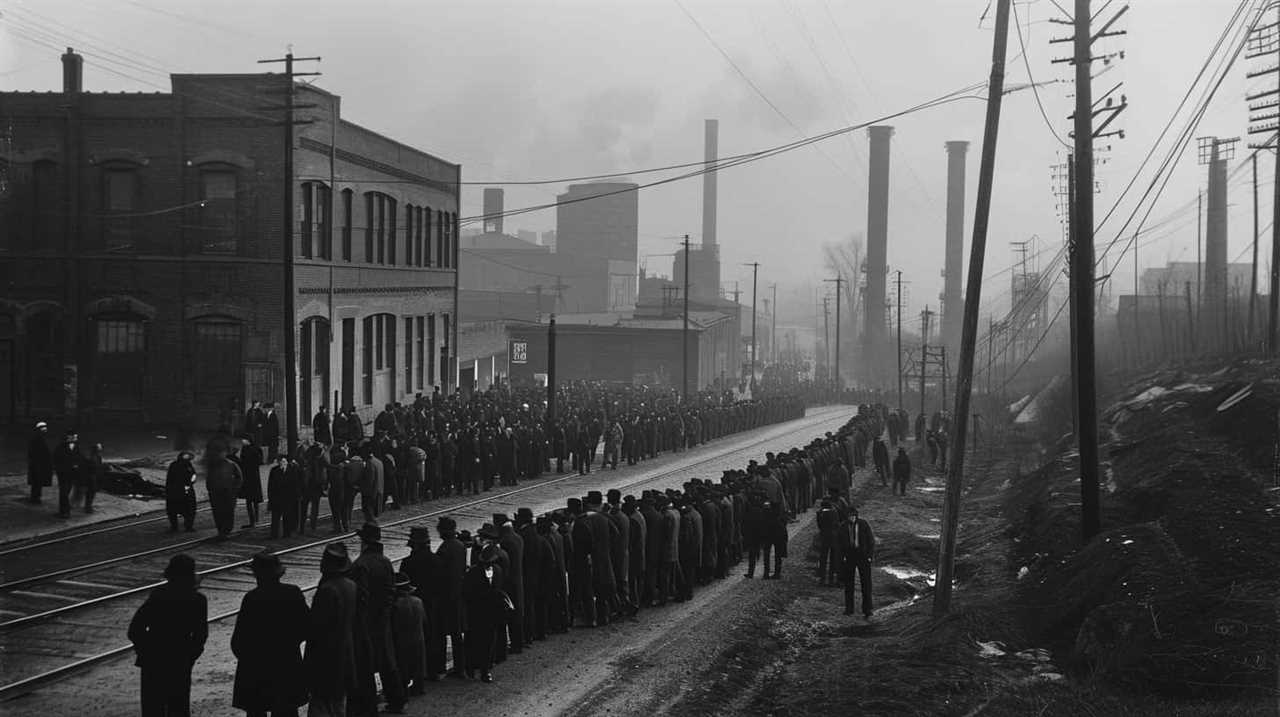

Hayek’s critique of central planning highlights the inefficiencies that arise from the lack of market signals and the central planner’s inability to accurately allocate resources.

Under central planning, resources are often misallocated due to the absence of price signals that convey information about consumer preferences and resource scarcity.

Moreover, Hayek argues that central planners face an inherent information problem since they can’t possess the dispersed knowledge that individuals possess in a market economy, making it impossible to make optimal decisions.

Inefficient Allocation Under Central Planning

Central planning leads to an inefficient allocation of resources, hindering economic growth and prosperity. Under central planning, resources are allocated by a central authority, rather than through the decentralized decision-making process of the market. This can result in several drawbacks:

- Lack of price signals: In a centrally planned economy, prices don’t reflect the true value of goods and services. Without accurate price signals, producers can’t efficiently allocate resources to meet consumer demands.

- Lack of competition: Central planning eliminates competition, which is a powerful driver of innovation and efficiency. Without competition, there’s little incentive for producers to improve their products or reduce costs.

- Inflexible decision-making: Central planning is often slow to respond to changing economic conditions. Decisions are made at a central level and implemented across the entire economy, leading to inflexibility and a lack of adaptability.

The inefficient resource allocation and other central planning drawbacks ultimately hinder economic growth and prosperity. However, these challenges can be overcome by embracing market-based mechanisms that provide better signals for resource allocation.

Lack of Market Signals

One significant critique of central planning is the lack of market signals, which hinders efficient resource allocation and economic growth.

Market efficiency relies on the information conveyed through prices, allowing producers and consumers to make rational decisions. In a centrally planned economy, where prices are set by authorities rather than determined by supply and demand, market signals are distorted or completely absent. This leads to misallocation of resources, as the true value of goods and services isn’t accurately reflected.

Price distortions occur when prices don’t accurately reflect the scarcity or abundance of a particular good or service. Without accurate market signals, resources are allocated inefficiently, resulting in wasted resources and slower economic growth.

Hayek’s critique of central planning emphasizes the importance of market signals for efficient resource allocation and underscores the potential negative consequences of disregarding them.

Hayek’s Information Problem

We understand the importance of accurate information in economic planning and the potential pitfalls that arise when central authorities lack access to market signals. Hayek’s critique of central planning revolves around the information problem inherent in such systems. Key aspects of this problem are information asymmetry and market efficiency.

- Information asymmetry:

- In a centrally planned economy, decision-making is based on limited information available to central authorities.

- The absence of market signals hampers the ability to gather real-time data on consumer preferences, production costs, and resource allocation.

- Market efficiency:

- Hayek argues that decentralized market systems, driven by price signals, are more efficient in allocating resources.

- The price mechanism conveys information about scarcity, demand, and supply, enabling individuals to make informed decisions and coordinate economic activity.

Price as a Reflection of Scarcity

As economists, it’s essential to recognize that prices serve as a clear indicator of scarcity within a market. When there’s a high demand for a product or service and a limited supply, scarcity arises. This scarcity drives up prices as consumers are willing to pay more to obtain the scarce resource. Understanding the concept of price elasticity is crucial to comprehending the relationship between scarcity and prices.

Price elasticity refers to the responsiveness of demand to changes in price. When a product is scarce, its price elasticity tends to be higher because consumers are more sensitive to price changes when there are limited alternatives available. As the scarcity of a product increases, consumers become more willing to pay higher prices. This is evident in situations where essential goods, such as medical supplies during a pandemic, become scarce. The demand for these goods is inelastic, meaning that consumers are willing to pay much higher prices to obtain them, regardless of the price increase.

Recognizing price as a reflection of scarcity allows policymakers to make informed decisions. By understanding the relationship between scarcity, demand, and price elasticity, policymakers can implement measures to alleviate scarcity and prevent price gouging. This could involve implementing regulations to ensure fair market competition, increasing production of scarce goods, or implementing price controls during times of crisis.

Decentralized Decision Making

Continuing from the previous subtopic, it’s crucial to understand how decentralized decision making plays a pivotal role in shaping economic policy.

Decentralized decision making refers to the process of individual actors making choices based on their own knowledge and preferences, rather than decisions being made by a central authority. This approach allows for market dynamics to determine resource allocation and price formation.

This brings several advantages to economic policy formulation.

- Efficient resource allocation: When decisions are made by individual actors in response to market signals, resources are allocated to their most productive uses. This leads to increased productivity and overall economic efficiency.

- Flexibility and adaptability: Decentralized decision making allows for quick adjustments to changing market conditions. As individual actors respond to shifts in demand and supply, the market can adapt and self-correct without the need for central planning.

Furthermore, decentralized decision making fosters innovation and entrepreneurship. By allowing individuals the freedom to pursue their own interests and ideas, it encourages the development of new products, services, and technologies.

Hayek’s Defense of Free Markets

Moving forward, it’s important to explore how Hayek’s price theory shapes economic policy by examining his staunch defense of free markets.

Hayek argued that free markets are the most effective means of achieving spontaneous order and efficient resource allocation in an economy. According to Hayek, the price system plays a crucial role in coordinating the actions of countless individuals, allowing them to make informed decisions about resource allocation.

Hayek believed that the decentralized nature of free markets allows for a more efficient allocation of resources compared to centralized planning. In a free market, prices act as signals that convey information about the scarcity and demand for goods and services. This information is processed by individuals who can then adjust their behavior accordingly. This process of decentralized decision-making leads to the spontaneous emergence of an efficient allocation of resources, as individuals respond to changing market conditions.

Furthermore, Hayek argued that free markets foster innovation and entrepreneurship. By allowing individuals the freedom to pursue their own interests and profit from their innovations, free markets encourage creativity and the development of new products and services. This constant process of innovation leads to economic growth and improved living standards.

Competition and Innovation

Competition and innovation are essential components of a dynamic market economy. Market dynamics drive innovation by creating incentives for entrepreneurial competition. This competition leads to the constant pursuit of new ideas and improvements, ultimately resulting in creative destruction and progress.

Hayek’s price theory recognizes the importance of competition in fostering innovation and highlights the role of market forces in driving economic growth.

Market Dynamics and Innovation

In the context of Hayek’s Price Theory, our understanding of market dynamics and innovation is shaped by the interplay between supply and demand, as well as the ever-evolving nature of consumer preferences.

When it comes to market competition, Hayek believed that it was crucial for promoting innovation. Competition among firms incentivizes them to constantly improve their products and services to attract customers and gain a competitive edge. This drive for innovation leads to technological advancements, as firms strive to develop more efficient and effective ways of meeting consumer demands.

Additionally, the dynamic nature of consumer preferences also plays a significant role in shaping market dynamics and innovation. As consumer tastes and preferences change over time, firms must constantly adapt and innovate to meet these evolving demands.

This constant interplay between market competition and technological advancement fuels innovation and drives economic progress.

Incentives for Entrepreneurial Competition

The interplay between supply and demand, along with the ever-evolving nature of consumer preferences, shapes the incentives for entrepreneurial competition in Hayek’s Price Theory.

In a market characterized by competition, entrepreneurs are driven to innovate in order to gain a competitive edge and capture a larger share of the market. The prospect of increased profits acts as a powerful incentive for innovation, as entrepreneurs seek to develop new products or improve existing ones to meet the changing needs and desires of consumers.

This constant drive for innovation not only leads to product improvements but also fosters market competition and growth. As entrepreneurs compete to provide better and more innovative solutions, consumers benefit from a wider range of choices and improved products, while the economy as a whole experiences increased productivity and economic growth.

Creative Destruction and Progress

Continuing our exploration of Hayek’s Price Theory, we delve into the concept of creative destruction and its role in driving progress through entrepreneurial competition and innovation.

Creative destruction refers to the constant process of new ideas and technologies replacing older ones, leading to economic growth and advancement. This process is driven by the competitive nature of the market, where businesses strive to innovate and outperform their rivals.

Through this competition, entrepreneurs are incentivized to develop new and improved products, processes, and services, pushing the boundaries of technological progress.

- Creative destruction drives progress by:

- Encouraging the development of new technologies and ideas

- Facilitating the adoption of more efficient and effective methods

- Technological progress is essential for:

- Improving productivity and increasing economic output

- Enhancing the quality of goods and services offered to consumers

Hayek’s View on Monopoly Power

Hayek emphasizes the detrimental effects of monopoly power on economic efficiency and individual freedom. He argues that monopolies distort market power dynamics, leading to inefficiencies and reduced innovation. According to Hayek, monopoly regulation is necessary to prevent these negative consequences.

Monopolies have the ability to charge higher prices and limit consumer choice, reducing economic efficiency. When a single company controls the market, it can exploit its market power to set prices above the competitive level. This leads to a misallocation of resources and a decrease in overall welfare.

In addition, monopolies tend to stifle innovation. Without competition, firms have less incentive to improve products or develop new technologies, ultimately hindering progress.

Furthermore, Hayek highlights the impact of monopolies on individual freedom. When a single company dominates a market, consumers and workers have limited options and bargaining power. This concentration of power undermines the principles of a free market economy, where individuals are free to make choices and engage in voluntary transactions.

To address these issues, Hayek advocates for effective monopoly regulation. He argues that governments should intervene to prevent the abuse of market power and ensure fair competition. By promoting competition, market dynamics can be restored, leading to greater efficiency, innovation, and individual freedom.

Price Stability and Inflation

In considering price stability and inflation, we recognize the importance of maintaining a stable and predictable economic environment. Achieving price stability is a key objective of monetary policy, as it provides a foundation for sustainable economic growth and innovation. Here are some key points to consider:

- Price stability ensures that the general level of prices remains relatively constant over time. This allows businesses and individuals to make informed decisions about spending, investment, and saving, without being unduly affected by sudden changes in prices.

- Stable prices provide a solid basis for long-term planning and investment. When prices are stable, businesses can accurately assess the costs and benefits of their projects, leading to more efficient allocation of resources and increased productivity.

- Price stability also fosters confidence in the economy, encouraging consumers to spend and businesses to invest. This creates a positive feedback loop, driving economic growth and innovation.

Monetary policy plays a crucial role in maintaining price stability. Central banks use various tools, such as interest rate adjustments and open market operations, to influence the supply of money and credit in the economy. By managing the money supply, central banks can help control inflation and promote price stability.

Hayek’s Perspective on Government Intervention

To understand the implications of Hayek’s price theory on economic policy, we must examine his perspective on government intervention. Hayek believed that government intervention, particularly in the form of central planning, could hinder the efficient functioning of the market. He argued that the knowledge required to allocate resources efficiently is dispersed among individuals and not centrally available to any governing body.

Hayek’s criticism of government intervention can be summarized in the following table:

| Government Intervention | Hayek’s Perspective |

|---|---|

| Central Planning | Inefficient |

| Resource Allocation | Decentralized |

| Knowledge | Dispersed |

| Market | Efficient |

| Hayek’s Solution | Free markets |

Hayek believed that central planning was inefficient because it relied on a centralized authority to make decisions that were better left to the market. He argued that the market, with its decentralized knowledge, was better equipped to allocate resources efficiently. Hayek’s solution was to promote free markets, where individual actors make decisions based on their unique knowledge and preferences.

Hayek’s Influence on Economic Policy

Hayek’s influence on economic policy can be seen through his policy impact, the applications of his price theory, and the implications for economic policy.

His ideas have shaped the way policymakers approach issues such as government intervention, regulation, and the role of markets.

Through his emphasis on the importance of price signals and the spontaneous order of the market, Hayek’s insights have had a lasting impact on economic policy decisions.

Hayek’s Policy Impact

Our understanding of economic policy has been significantly shaped by Hayek’s influential ideas on price theory.

Hayek’s policy impact can be seen in the emphasis placed on policy effectiveness and market efficiency.

- Policy Effectiveness:

- Hayek argued that government intervention in the economy should be limited, as it often leads to unintended consequences and inefficiencies.

- His ideas have influenced policymakers to prioritize policies that are evidence-based and have clear objectives, ensuring that resources are allocated efficiently.

- Market Efficiency:

- Hayek’s emphasis on the importance of price signals in coordinating economic activity has led to a greater focus on free markets and competition.

- Policymakers have sought to reduce barriers to entry and promote market competition to enhance efficiency and encourage innovation.

Price Theory Applications

Applying Hayek’s price theory to economic policy involves utilizing market signals to guide decision-making and improve resource allocation. By understanding market dynamics and the role of prices as information signals, policymakers can design innovative policies that promote efficiency and economic growth.

Hayek argued that the price system is a powerful mechanism for coordinating decentralized knowledge and allowing individuals to make informed choices. This approach emphasizes the importance of allowing market forces to determine prices and allocate resources, rather than relying on centralized planning.

By embracing Hayek’s price theory, policymakers can harness market forces to drive innovation, encourage competition, and foster entrepreneurship. This leads to a more dynamic and adaptable economy that can respond to changing conditions and promote long-term prosperity.

Transitioning to the subsequent section on economic policy implications, it’s essential to explore how Hayek’s ideas can inform specific policy measures.

Economic Policy Implications

By understanding the applications of price theory to economic policy, we can shape our policies to promote efficiency and economic growth. Hayek’s influence on economic policy has significant implications for achieving these goals.

Here are two key implications:

- Promoting economic growth: Hayek’s price theory emphasizes the importance of free markets and individual decision-making. By allowing prices to adjust freely based on supply and demand, resources are allocated efficiently, leading to increased productivity and economic growth. Implementing policies that support market competition and reduce barriers to entry can foster innovation and entrepreneurship, further fueling economic expansion.

- Addressing income inequality: Hayek believed that income inequality is a natural outcome of a free market system, but he also recognized the importance of social safety nets. By providing targeted assistance to those facing the most severe hardships, policies can help mitigate the negative effects of inequality while still preserving the incentives for individual effort and innovation that drive economic growth.

Challenges to Hayek’s Price Theory

One major challenge to Hayek’s Price Theory is the inherent complexity of real-world markets. While Hayek’s theory emphasizes the importance of prices as signals of scarcity and guides for resource allocation, it assumes that markets are perfectly competitive and participants have perfect information. In reality, markets are often imperfect and information is incomplete or asymmetric. This creates challenges to the efficient functioning of prices as indicators of scarcity and value.

One critique of Hayek’s Price Theory is that it fails to account for externalities, which are costs or benefits that are not reflected in market prices. For example, pollution from production processes may impose costs on society that are not captured by prices. Additionally, Hayek’s focus on individual decision-making may not adequately address the collective action problems that arise in areas such as environmental conservation or public goods provision.

| Challenges to Hayek’s Price Theory |

|---|

| Inherent complexity of real-world markets |

| Failure to account for externalities |

| Limited applicability in addressing collective action problems |

Despite these challenges, Hayek’s Price Theory has had a significant impact on economic policy. It has provided valuable insights into the role of prices in coordinating economic activity and has influenced the design of market-oriented policies. However, it is important to acknowledge and address the limitations and critiques of the theory to ensure that economic policies are effective and equitable in the face of real-world complexities.

Frequently Asked Questions

How Does Hayek’s Price Theory Explain the Concept of Spontaneous Order?

Spontaneous order, a concept explained by Hayek’s price theory, refers to the self-organizing nature of markets. It arises from the decentralized coordination of countless individuals pursuing their own interests, resulting in efficient allocation of resources without central planning.

What Is the Role of Prices in Allocating Resources According to Hayek’s Price Theory?

The role of prices in resource allocation is central to Hayek’s price theory. Prices act as signals, guiding individuals and businesses to allocate resources efficiently. This promotes innovation and economic growth.

How Do Market Signals and Information Play a Part in Hayek’s Price Theory?

Market signals and information are vital components of Hayek’s price theory. They enable efficient allocation of resources and facilitate price discovery. By harnessing these mechanisms, market participants can make informed decisions that drive innovation and enhance economic outcomes.

What Are Some of the Key Critiques Hayek Had Regarding Central Planning?

Hayek’s central planning critiques highlight the limitations of relying on centralized decision-making in the economy. By emphasizing the importance of individual knowledge and market signals, he argues for a more decentralized approach to economic policy.

How Does Price Serve as a Reflection of Scarcity in Hayek’s Price Theory?

In Hayek’s price theory, price serves as a reflection of scarcity. It is a key signal that guides market equilibrium and allocation of resources. This understanding shapes our economic policy decisions.

How Does Hayek’s Price Theory Influence Economic Policy?

Hayek’s price theory offers valuable insights on Hayek’s price theory how prices convey information about supply and demand. This influences economic policy by emphasizing the importance of allowing prices to freely adjust to market conditions. Such flexibility can lead to more efficient resource allocation and better economic outcomes.

Conclusion

In conclusion, Friedrich Hayek’s price theory has had a profound impact on economic policy.

One interesting statistic that highlights its significance is that countries with more market-oriented economies, influenced by Hayek’s ideas, tend to have higher levels of economic freedom and prosperity.

For example, according to the Heritage Foundation’s Index of Economic Freedom, countries with greater economic freedom have higher average incomes and lower poverty rates.

Hayek’s emphasis on the role of prices in allocating resources and his critique of central planning have shaped policies that promote market efficiency and individual freedom.

Lauren’s talent in writing is matched by her passion for storytelling. Her love for books and deep understanding of culture and entertainment add a distinct flavor to her work. As our media and press contact, Lauren skillfully bridges the gap between afterQuotes and the broader media landscape, bringing our message to a wider audience.