Initially, the realm of economics may appear intimidating, with its elaborate theories and intricate ideas. Rest assured, the mysteries surrounding one of the most influential economic principles, comparative advantage, can be explained with simplicity and creativity.

In our exploration of the life and work of David Ricardo, we will dive into the depths of this theory and reveal its profound impact on global trade. Some may argue that understanding comparative advantage is reserved for the elite few, but we believe that with a fresh perspective and a desire for innovation, anyone can grasp its significance.

Join us as we unravel the mysteries behind David Ricardo’s groundbreaking insights and uncover the secrets of comparative advantage.

Key Takeaways

- David Ricardo was influenced by Adam Smith and Thomas Malthus in his early education, and his studies in mathematics and finance shaped his theories.

- Ricardo’s labor theory of value determined the value of a product or service, and it had implications for economic specialization and trade.

- Comparative advantage is defined as producing at a lower opportunity cost, and it is influenced by factors such as labor productivity, technology, education, and infrastructure.

- Comparative advantage brings economic benefits such as increased productivity, job opportunities, reduced unemployment rates, trade deficit reduction, and enhanced economic efficiency.

Early Life and Education

In our exploration of David Ricardo’s life, we find that his early education provided him with a solid foundation for his future achievements. Ricardo’s thinking was heavily influenced by the intellectual climate of his time, specifically by the works of Adam Smith and Thomas Malthus. Smith’s ‘The Wealth of Nations’ introduced Ricardo to the concept of free trade and the benefits of specialization, while Malthus’s ‘An Essay on the Principle of Population’ shaped his understanding of the relationship between population growth and resources.

Ricardo’s education also played a crucial role in shaping his economic policies. His studies in mathematics and finance enabled him to develop a keen understanding of numbers and financial systems. This expertise laid the groundwork for his groundbreaking theories on comparative advantage and the theory of rent.

The impact of Ricardo’s early education on his economic policies can’t be overstated. His ideas on free trade and the benefits of specialization challenged the prevailing mercantilist policies of the time. Ricardo’s theories provided a framework for governments to adopt policies that promoted international trade and economic growth. His work continues to influence economists and policymakers to this day, as his ideas are still relevant in our increasingly interconnected global economy.

Ricardo’s Theory of Value

Our exploration of David Ricardo’s life and ideas now turns to Ricardo’s theory of value. Ricardo’s theory of value is rooted in the labor theory, which posits that the value of a commodity is determined by the amount of labor required to produce it. According to Ricardo, the labor expended in the production of a good is the ultimate source of its value.

Ricardo argued that the labor theory of value provides a foundation for understanding the distribution of economic benefits. He believed that in a competitive market, the prices of goods would tend to align with their labor values. This meant that the value of a good would be determined by the amount of labor required to produce it, rather than by its utility or scarcity.

The labor theory of value has significant implications for understanding the benefits of economic specialization and trade. Ricardo’s theory suggests that countries should focus on producing the goods in which they’ve a comparative advantage, that is, where they can produce at a lower opportunity cost. By specializing in these areas and trading with other countries, both parties can benefit and achieve higher levels of economic welfare.

With this understanding of Ricardo’s theory of value, we can now delve deeper into the concept of the labor theory and its implications for economic theory and policy.

Labor Theory of Value

The labor theory of value provides a foundation for understanding the distribution of economic benefits. It’s a concept that suggests that the value of a product or service is determined by the amount of labor required to produce it. According to this theory, the more labor-intensive a product is, the more valuable it is. This idea has important implications for international trade and labor productivity.

In the context of international trade, the labor theory of value helps explain why certain countries specialize in the production of specific goods or services. Countries with a comparative advantage in labor-intensive industries, such as manufacturing or agriculture, can produce these goods more efficiently and at a lower cost. This allows them to export these products and benefit from international trade.

Furthermore, the labor theory of value also sheds light on the concept of labor productivity. By understanding the relationship between labor input and output, policymakers and businesses can identify ways to improve productivity and enhance economic growth. This can be achieved through investments in technology, education, and infrastructure, which can help increase the efficiency and effectiveness of labor.

Comparative Advantage Defined

Comparative advantage refers to the ability of a country or individual to produce goods or services at a lower opportunity cost than others. This concept is crucial in understanding the economic benefits of trade.

By specializing in the production of goods or services in which they have a comparative advantage, countries can increase their overall efficiency and output.

Factors that affect comparative advantage include differences in resource endowments, technology, and skills. Understanding these factors is essential in determining the most efficient allocation of resources and maximizing economic gains.

Economic Benefits of CA

Although often overlooked, understanding the economic benefits of comparative advantage is crucial for grasping the significance of David Ricardo’s theory. Comparative advantage has a profound impact on employment and trade deficits, providing several key benefits:

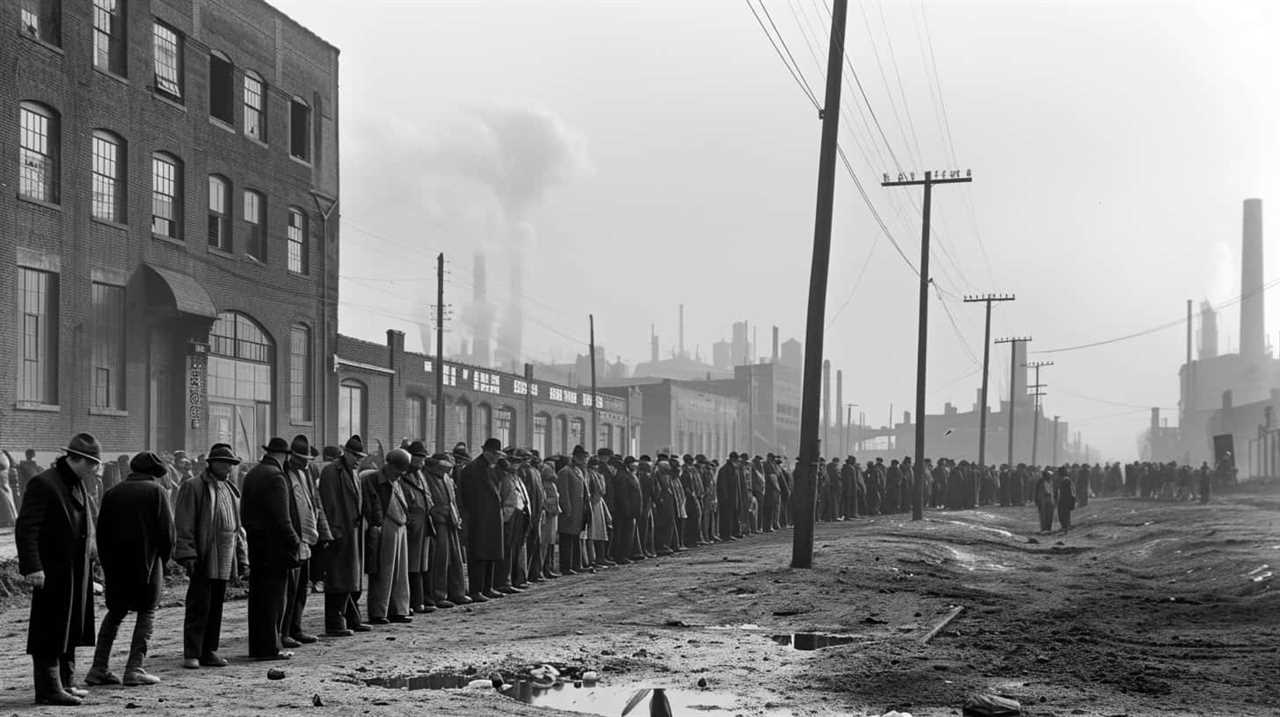

- Increased employment opportunities: Comparative advantage allows countries to focus on producing goods and services in which they’ve a competitive edge. This specialization leads to increased productivity, creating new job opportunities and reducing unemployment rates.

- Trade deficit reduction: By exporting goods and services that they’ve a comparative advantage in, countries can generate revenue and reduce their trade deficits. This helps to balance the overall trade flow and improve a country’s economic stability.

- Enhanced economic efficiency: Comparative advantage promotes efficiency by encouraging countries to allocate their resources effectively. This leads to improved productivity, lower costs, and ultimately higher economic growth.

Understanding and harnessing the economic benefits of comparative advantage can drive innovation, economic growth, and global trade integration. It’s essential for policymakers and business leaders to recognize and leverage these advantages in order to foster sustainable economic development.

Factors Affecting CA

Several key factors influence the establishment and understanding of comparative advantage. These factors affect trade and have a significant impact on domestic industries. When analyzing these factors, it becomes evident that they play a crucial role in shaping the competitive landscape of nations.

To better comprehend the factors affecting comparative advantage, let us consider the following table:

| Factors Affecting Trade | Impact on Domestic Industries |

|---|---|

| Technological advancements | Enhances productivity and efficiency |

| Natural resource endowments | Determines resource availability |

| Education and skill levels | Shapes labor productivity |

| Infrastructure development | Influences transportation and logistics capabilities |

Technological advancements, natural resource endowments, education and skill levels, and infrastructure development are all key factors that contribute to a country’s comparative advantage. These factors directly impact the competitiveness of domestic industries and their ability to compete in the global market.

Understanding these factors is crucial for policymakers and industry leaders as they strive to foster innovation and drive economic growth. By leveraging their comparative advantages, countries can position themselves as leaders in industries where they have a competitive edge.

In the subsequent section, we will explore the key assumptions of comparative advantage and delve deeper into the intricacies of this economic theory.

Key Assumptions of Comparative Advantage

The key assumptions of comparative advantage form the foundation upon which the concept is built.

By assuming that resources are immobile between countries, that there are differences in productivity levels, and that trade is unrestricted, comparative advantage can be understood and analyzed.

These assumptions allow economists to explore the implications of comparative advantage, such as the potential gains from trade and the specialization of countries in producing goods and services in which they have a comparative advantage.

Assumptions Behind Comparative Advantage

We believe that understanding the assumptions behind comparative advantage is crucial in grasping the foundations of this economic theory. Here are three key assumptions that underpin the concept of comparative advantage:

- Perfect labor mobility: This assumption assumes that labor can easily move between industries without any costs or restrictions. In reality, labor mobility can be limited by factors such as skills mismatch, geographical barriers, and legal restrictions.

- Constant returns to scale: Comparative advantage assumes that the production of goods exhibits constant returns to scale, meaning that doubling the inputs doubles the output. However, in practice, economies of scale and diseconomies of scale can affect the production process.

- No transportation costs or trade barriers: Comparative advantage assumes that there are no transportation costs or trade barriers, allowing for seamless trade between countries. In reality, transportation costs and trade barriers can impact the viability of international trade and have implications for the competitiveness of local industries.

Understanding the validity of these assumptions and their impact on local industries is essential for evaluating the applicability of comparative advantage in real-world economic scenarios.

Implications of Comparative Advantage

As we delve into the implications of comparative advantage, it becomes evident that the key assumptions underlying this economic theory play a crucial role in shaping its practical applicability.

These assumptions provide the foundation for understanding how countries can benefit from specializing in the production of goods and services in which they’ve a comparative advantage.

Two key assumptions are essential in this regard: constant opportunity cost and perfect competition. Constant opportunity cost assumes that the opportunity cost of producing a good remains the same, regardless of the quantity produced. Perfect competition assumes that there are no barriers to trade and that resources are fully mobile.

These assumptions allow for efficient allocation of resources, leading to economic growth and improved trade balance.

With these assumptions in mind, let’s now explore Ricardo’s example of cloth and wine, which further illustrates the concept of comparative advantage.

Ricardo’s Example of Cloth and Wine

When discussing Ricardo’s example of cloth and wine, it’s important to understand how the concept of comparative advantage plays a crucial role in explaining international trade. Ricardo’s example demonstrates the implications of specialization and the economic benefits of trade.

Here are three key points to consider:

- Comparative advantage allows countries to specialize in producing goods in which they have a lower opportunity cost. In Ricardo’s example, Portugal has a comparative advantage in producing wine, while England has a comparative advantage in producing cloth. By focusing on their respective strengths, both countries can maximize their productivity and efficiency.

- Specialization leads to increased productivity and output. When countries specialize in producing goods they are relatively more efficient at producing, they can achieve economies of scale, lower production costs, and higher output. This leads to increased overall production and economic growth.

- Trade based on comparative advantage allows countries to consume a greater variety of goods at lower prices. By trading the goods in which they have a comparative advantage, countries can access goods that they aren’t able to produce efficiently themselves. This increases consumer choices and lowers prices, improving the standard of living for all involved.

Ricardo’s example of cloth and wine showcases the power of comparative advantage in promoting specialization and driving economic growth through international trade. By recognizing and embracing each country’s unique strengths, nations can unlock their full potential and foster innovation in the global marketplace.

Benefits of Specialization and Trade

How do specialization and trade contribute to economic growth and improved living standards?

Specialization and trade play a crucial role in driving economic growth and improving living standards. By allowing countries to focus on producing goods and services that they have a comparative advantage in, specialization ensures efficient resource allocation. This means that resources are directed towards the production of goods and services where a country can produce at a lower opportunity cost compared to other countries. As a result, countries can maximize their output and productivity, leading to increased economic growth.

Through trade, countries can exchange their specialized goods and services with others, further enhancing economic growth. Trade allows countries to access a wider variety of products and services that may not be available domestically. This promotes innovation and competition, as countries strive to improve their products to compete in the global market. Additionally, trade leads to the transfer of knowledge and technology, which can have positive spillover effects on domestic industries.

Moreover, specialization and trade lead to improved living standards. By specializing in the production of goods and services that a country can produce most efficiently, resources are utilized more effectively, resulting in higher incomes and job opportunities. This leads to increased purchasing power and a higher standard of living for individuals. Furthermore, trade allows consumers to access a wider variety of goods and services at lower prices, boosting their overall well-being.

Opposing Views and Criticisms

Some opposing views and criticisms regarding David Ricardo’s theory of comparative advantage include questioning the validity of the assumptions on which the theory is based, concerns about the impact on local industries, and the potential exacerbation of global economic inequality.

Critics argue that the assumption of constant opportunity costs may not always hold true in reality, leading to a misallocation of resources.

Furthermore, the theory’s emphasis on specialization and trade may result in the decline of domestic industries, leading to job losses and economic dislocation.

Lastly, some argue that comparative advantage can perpetuate global economic inequality, as developing countries may become dependent on exporting low-value goods while developed countries benefit from advanced technology and higher-value products.

Validity of Assumptions

One might question the validity of certain assumptions underlying the theory of comparative advantage. While the theory has been widely accepted and influential in the field of international trade, it isn’t without its criticisms and opposing views. Here are three key points to consider:

- Contextual limitations: Critics argue that the theory assumes static conditions and fails to account for dynamic changes in economies, such as shifts in technology or resource availability.

- Distributional concerns: Opponents suggest that comparative advantage can lead to unequal gains and distribution of benefits, particularly in developing countries where industries may struggle to compete.

- Unrealistic assumptions: Some argue that the theory relies on simplifying assumptions, such as perfect competition and full employment, which don’t accurately reflect real-world conditions.

While the theory of comparative advantage has its detractors, it remains a valuable framework for understanding the benefits of trade and specialization in a global economy.

Impact on Local Industries

Continuing from our previous discussion on the validity of assumptions, let us now delve into the impact of comparative advantage on local industries. While the theory of comparative advantage suggests that countries should specialize in the production of goods and services in which they have a comparative advantage, there are opposing views and criticisms regarding its effects on domestic industries.

One of the main concerns raised is the impact on employment. Critics argue that when industries in developed countries shift production to countries with a comparative advantage, it leads to job losses in the domestic market. This can have negative implications for workers and communities who rely on these industries for employment.

To provide a clearer understanding of the effects on domestic industries, let us take a look at the following table:

| Effects on Domestic Industries | Pros | Cons |

|---|---|---|

| Impact on Employment | – Increased job opportunities in industries with a comparative advantage | – Job losses in industries that cannot compete |

| — | — | — |

It is crucial to consider these opposing views and criticisms when analyzing the impact of comparative advantage on local industries.

Global Economic Inequality

To further explore the impact of comparative advantage on global economic inequality, let’s now examine the opposing views and criticisms surrounding this issue.

While the concept of comparative advantage has been praised for its potential to promote economic growth and efficiency on a global scale, there are valid concerns regarding its impact on local industries and global economic inequality.

Critics argue that comparative advantage can lead to job losses and industrial decline in certain countries, particularly those with less competitive industries. This can exacerbate global economic inequality, as wealthier nations benefit at the expense of poorer ones.

Another concern is that comparative advantage may perpetuate a cycle of dependency, with developing countries trapped in low-value industries and unable to diversify their economies.

Additionally, critics argue that comparative advantage can result in the exploitation of labor and resources in countries with weaker regulations, further contributing to global economic inequality.

These opposing views highlight the complex nature of global economic inequality and the need for careful consideration when implementing policies related to comparative advantage.

Modern Applications of Comparative Advantage

We have identified several modern applications of comparative advantage. This concept has far-reaching economic implications and continues to shape various industries and global trade.

One prominent application is in the field of outsourcing. Companies often seek to outsource certain tasks or processes to countries where they have a comparative advantage. For example, technology companies may outsource their customer service operations to countries with lower labor costs. This allows them to focus on their core competencies while taking advantage of cost savings.

Another modern application of comparative advantage is seen in international trade agreements. Countries often specialize in producing goods and services in which they have a comparative advantage, and then trade with other countries to obtain goods and services in which they don’t have a comparative advantage. This promotes efficiency and market expansion, benefiting all participating countries.

Moreover, the rise of global supply chains has further highlighted the importance of comparative advantage. Companies can strategically locate their production facilities in different countries to take advantage of the specialized skills and resources available. This allows for increased efficiency and competitiveness in the global market.

As we explore Ricardo’s impact on international trade, it’s important to recognize how his theory of comparative advantage continues to shape and influence modern economic practices.

Ricardo’s Impact on International Trade

Ricardo’s theories on comparative advantage have had a profound impact on international trade. By emphasizing the benefits of specialization and trade, Ricardo’s work laid the foundation for the concept of global economic integration.

The idea that countries should focus on producing goods in which they have a comparative advantage and trade with others for goods they cannot produce efficiently has led to increased efficiency, higher productivity, and overall welfare gains in the global economy.

Trade and Specialization

One key aspect of trade and specialization is the significant impact that David Ricardo had on international trade.

Ricardo’s ideas on comparative advantage revolutionized the way nations engage in trade and led to increased economic growth worldwide.

His theory postulated that countries should specialize in producing goods and services that they’ve a comparative advantage in, and then trade with other nations to obtain goods and services that they don’t produce efficiently.

This concept challenged the prevailing notion of trade barriers and protectionism, advocating for free trade as a means to maximize global welfare.

Ricardo’s ideas have influenced trade policies and negotiations, promoting openness and cooperation among nations.

As a result, countries have been able to tap into their strengths and leverage the benefits of specialization, leading to increased productivity and innovation in the global marketplace.

Global Economic Integration

Continuing from the previous subtopic, the impact of David Ricardo on international trade extends to global economic integration.

Ricardo’s theory of comparative advantage has provided the foundation for the process of globalization. Globalization refers to the increasing interconnectedness and interdependence of countries through the exchange of goods, services, capital, and ideas.

Ricardo’s insight that countries should specialize in the production of goods in which they have a comparative advantage has led to the dismantling of trade barriers and the promotion of free trade. By embracing free trade, countries have been able to expand their markets and access a wider range of goods and services, leading to increased efficiency and innovation.

Global economic integration hasn’t only facilitated the flow of goods and services but also created opportunities for collaboration, knowledge sharing, and technological advancements.

Benefits of Free Trade

Global economic integration has been greatly influenced by David Ricardo, as his theory of comparative advantage has led to the promotion of free trade and the subsequent benefits it brings. Free trade, based on Ricardo’s principles, has had a profound impact on economic growth and job creation.

Benefits of free trade include:

- Increased market access: Free trade allows countries to expand their markets beyond their domestic borders, leading to increased sales and revenue for businesses.

- Efficiency gains: By specializing in the production of goods and services in which they’ve a comparative advantage, countries can maximize their efficiency and productivity, resulting in higher output levels.

- Consumer welfare: Free trade promotes competition, leading to lower prices and a wider variety of products for consumers, enhancing their overall welfare.

These benefits of free trade have been instrumental in driving global economic growth and creating new job opportunities, making Ricardo’s impact on international trade invaluable in today’s interconnected world.

Relevance of Comparative Advantage Theory Today

From our perspective, the theory of comparative advantage remains highly relevant in today’s global economy. The relevance of the comparative advantage theory can be seen in developing countries, where it can serve as a framework for economic growth and development.

Developing countries often have abundant resources but lack the necessary technology and skills to efficiently utilize them. The theory of comparative advantage suggests that these countries should focus on producing goods and services in which they’ve a comparative advantage, even if they aren’t the most efficient producers globally. By specializing in these areas, developing countries can increase their competitiveness and attract foreign investment.

Moreover, the impact of technological advancements on comparative advantage can’t be ignored. Technological advancements have the potential to level the playing field and reduce the traditional advantages of developed countries. For example, advancements in communication technology have made it easier for developing countries to participate in global trade and access international markets. This has allowed them to tap into global supply chains, collaborate with foreign partners, and benefit from economies of scale.

Ricardo’s Influence on Economic Thought

Ricardo’s influence on economic thought is significant and far-reaching. His ideas have shaped the way we understand economic growth and market competition. Here are three key ways in which Ricardo’s influence continues to impact economic thought:

- Comparative advantage: Ricardo’s concept of comparative advantage revolutionized international trade theory. By demonstrating that countries can benefit from specializing in the production of goods and services in which they’ve a lower opportunity cost, he paved the way for a more efficient allocation of resources and increased global trade.

- Free trade: Ricardo’s advocacy for free trade as a means to promote economic growth and welfare continues to resonate in modern economic thinking. His arguments against protectionism and tariffs have influenced policymakers and economists alike, promoting the idea that open markets foster competition, innovation, and efficiency.

- Distribution of income: Ricardo’s theory of rent, which explores the distribution of income between landowners and laborers, has had a lasting impact on the field of economics. His analysis of economic rent and its effects on income inequality has shaped our understanding of the relationship between land, labor, and income distribution.

Ricardo’s ideas haven’t only shaped economic theory but have also informed policy debates and influenced decision-making. His insights into comparative advantage, free trade, and income distribution continue to be relevant in today’s ever-changing global economy.

Misconceptions About Comparative Advantage

One common misconception about comparative advantage is that it only applies to countries with lower production costs. While it is true that comparative advantage often leads to trade between countries with differing production costs, it is not limited to this scenario. Comparative advantage is based on the concept that countries should specialize in producing goods or services in which they have a lower opportunity cost compared to other countries. This means that even if a country has higher production costs, it can still benefit from trading with another country if it has a lower opportunity cost in producing a particular good or service.

To illustrate this point, let’s consider a hypothetical example of two countries, A and B, and their comparative advantage in producing goods X and Y:

| Country A | Country B | |

|---|---|---|

| Good X | High cost | Low cost |

| Good Y | Low cost | High cost |

In this example, although Country B has higher production costs overall, it still has a comparative advantage in producing Good X due to its lower opportunity cost. Conversely, Country A has a comparative advantage in producing Good Y. By trading with each other, both countries can benefit from specializing in the production of goods in which they have a comparative advantage, leading to increased efficiency and overall economic growth.

Real-world examples of comparative advantage can be found in industries such as technology, where countries like the United States and China have specialized in different aspects of production, such as software development and hardware manufacturing. By capitalizing on their respective comparative advantages, these countries have fostered innovation and global competitiveness in the tech sector.

Debates Surrounding Free Trade Policies

We believe that the debates surrounding free trade policies are essential in understanding the implications and impacts of these policies on global economies. These debates have been ongoing for decades, with proponents arguing that free trade promotes economic growth, fosters competition, and leads to lower prices for consumers. On the other hand, critics argue that free trade can have negative consequences, particularly for local industries. Here are three key points to consider:

- Impact of protectionism on local industries: Critics of free trade argue that it can lead to the decline of domestic industries, as they struggle to compete with cheaper imports from foreign countries. This can result in job losses and economic hardships for workers in those industries.

- Balancing economic growth and domestic interests: Free trade policies aim to promote economic growth and increase overall welfare. However, it’s crucial to strike a balance between economic growth and protecting the interests of domestic industries. This requires implementing policies that support and nurture local industries without completely shutting out foreign competition.

- The role of government intervention: Debates surrounding free trade policies often center around the role of government intervention. Proponents of free trade argue for minimal government interference, while critics advocate for protective measures, such as tariffs and subsidies, to safeguard local industries.

Understanding the debates around free trade policies is fundamental in shaping effective policies that maximize the benefits and minimize the drawbacks.

Now, let’s delve into the lessons we can learn from Ricardo’s comparative advantage theory.

Lessons From Ricardo’s Comparative Advantage Theory

Let’s explore the valuable insights that Ricardo’s theory of comparative advantage offers. This theory has significant implications for developing countries and plays a crucial role in globalization.

Ricardo argued that countries should specialize in producing goods and services where they’ve a comparative advantage, even if they can produce all goods more efficiently than other nations. This means that even if a country can produce all goods at a lower cost, it should focus on producing and exporting the goods it can produce most efficiently. By doing so, countries can benefit from international trade and achieve higher levels of economic growth.

For developing countries, Ricardo’s theory offers a pathway to economic development. By identifying their comparative advantage and focusing on producing and exporting those goods, developing countries can participate in global markets and attract foreign investment. This can lead to increased employment, improved infrastructure, and technological advancements.

Furthermore, Ricardo’s theory highlights the importance of international trade and globalization. By engaging in trade, countries can access a wider range of goods and services, benefit from economies of scale, and promote innovation. Globalization allows for the exchange of ideas and knowledge, leading to increased productivity and efficiency.

Frequently Asked Questions

Was David Ricardo’s Theory of Comparative Advantage Widely Accepted During His Time?

During his time, David Ricardo’s theory of comparative advantage was not widely accepted. However, over time, it has had a significant impact on global trade and has influenced the development of international trade agreements.

How Does Ricardo’s Theory of Comparative Advantage Apply to Other Industries Besides Cloth and Wine?

Comparative advantage in technology expands beyond cloth and wine. The impact of globalization has transformed industries, creating new opportunities for countries to specialize and trade based on their strengths, resulting in economic growth and innovation.

What Are Some Potential Drawbacks or Disadvantages of Specialization and Trade Based on Ricardo’s Theory?

Some potential drawbacks of specialization and trade based on Ricardo’s theory include the risk of overdependence on a specific industry, loss of domestic jobs, and vulnerability to global market fluctuations. Critics argue that the theory may not apply equally to all industries.

How Has Ricardo’s Theory of Comparative Advantage Influenced Economic Policies and Trade Agreements Today?

Ricardo’s theory of comparative advantage has had a significant influence on globalization and trade agreements. It has shaped economic policies by promoting specialization and encouraging countries to engage in mutually beneficial trade relationships.

Are There Any Notable Economists Who Have Criticized or Challenged Ricardo’s Theory of Comparative Advantage?

Critiques of Ricardo’s theory of comparative advantage have been raised by notable economists. However, alternative theories have not gained widespread acceptance due to the evidence-based nature of Ricardo’s theory and its influence on economic policies and trade agreements today.

Conclusion

In conclusion, David Ricardo’s theory of comparative advantage remains a foundational concept in economics.

Just as a delicate ecosystem thrives when each organism specializes in its unique role, global trade flourishes when countries specialize in producing goods and services they’re most efficient at.

Like a symphony where each instrument plays its part to create a harmonious melody, Ricardo’s theory highlights the benefits of cooperation and specialization in achieving overall economic prosperity.

Lauren’s talent in writing is matched by her passion for storytelling. Her love for books and deep understanding of culture and entertainment add a distinct flavor to her work. As our media and press contact, Lauren skillfully bridges the gap between afterQuotes and the broader media landscape, bringing our message to a wider audience.