Have you ever wondered why some countries excel in producing certain goods and services while others struggle?

Well, let’s take a moment to consider the story of David Ricardo, a renowned economist who championed the concept of comparative advantage. Ricardo, living in the early 19th century, observed that England, despite having the capability to produce both wine and cloth, focused on cloth production while Portugal specialized in wine. This specialization allowed both countries to maximize their output and increase overall productivity.

But why did Ricardo champion this idea? The answer lies in his understanding of opportunity cost and the potential for economic growth through international trade.

In this introduction, we will explore the factors that led Ricardo to embrace the concept of comparative advantage and its relevance in today’s innovative world.

Key Takeaways

- David Ricardo championed the concept of comparative advantage in the early 19th century.

- Comparative advantage allows countries to specialize in the production of goods and services they are most efficient at.

- Factors influencing comparative advantage include differences in labor productivity, natural resources, technological advancements, and economies of scale.

- Comparative advantage is a vital concept in today’s global economy, optimizing resource allocation and promoting international trade.

The Concept of Comparative Advantage

In our exploration of the concept of comparative advantage, we’ll delve into the reasons why Ricardo championed this economic principle. Comparative advantage serves as a crucial framework for understanding international trade and optimizing resource allocation. Its applications are vast and varied, making it a vital concept in today’s global economy.

One of the key applications of comparative advantage lies in trade. By focusing on producing goods and services that we’ve a comparative advantage in, we can maximize efficiency and productivity. This allows countries to specialize in the production of goods or services they’re most efficient at, and then engage in trade with other countries to obtain goods and services they’re less efficient at producing. This results in a mutually beneficial exchange and leads to overall economic growth.

Several factors influence comparative advantage. These include differences in labor productivity, natural resources, technological advancements, and economies of scale. Countries with abundant natural resources may have a comparative advantage in industries such as mining or agriculture. Similarly, countries with advanced technological capabilities may have a comparative advantage in high-tech industries.

In conclusion, the concept of comparative advantage provides a framework for optimizing resource allocation and promoting international trade. By understanding the applications of comparative advantage and the factors that influence it, countries can make informed decisions to enhance their economic growth and innovation.

Now, let’s explore the benefits of trade in more detail.

Trade and Its Benefits

Trade plays a crucial role in driving economic growth by allowing countries to specialize in the production of goods and services in which they have a comparative advantage. This leads to increased efficiency, productivity, and innovation, ultimately resulting in higher living standards for all participating nations.

In addition, trade provides consumers with a wider range of choices and access to goods and services from around the world, enhancing their overall welfare.

Furthermore, trade fosters international cooperation and peace by creating interdependence and mutual benefits among nations, reducing the likelihood of conflicts and promoting diplomatic relationships.

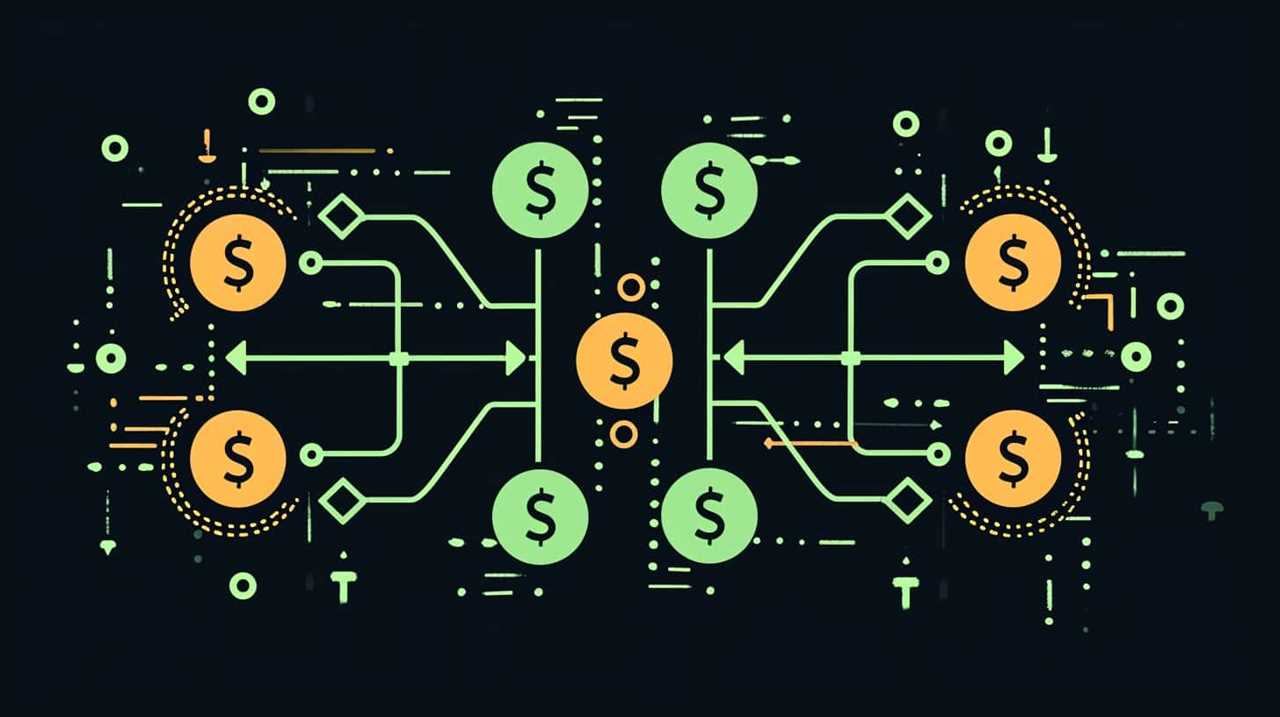

Economic Growth Through Trade

Our research has found that engaging in international commerce can lead to significant economic growth for nations. Trade allows countries to specialize in the production of goods and services in which they have a comparative advantage, leading to increased productivity and efficiency. This, in turn, drives economic growth and reduces economic inequality by creating job opportunities and raising incomes. Additionally, trade promotes innovation and technological advancements as countries compete to improve their products and processes. It also encourages investment and fosters international cooperation, which further contributes to economic growth. However, it is important to note that protectionism, such as imposing tariffs or trade barriers, can hinder economic growth by limiting market access and stifling competition. Therefore, it is crucial for nations to embrace free trade and remove barriers to foster economic growth and prosperity.

| Advantages of Trade | Disadvantages of Trade | Benefits of Trade |

|---|---|---|

| Increased productivity | Economic inequality | Job creation |

| Efficiency gains | Protectionism | Technological advancements |

| Innovation | Limited market access | International cooperation |

| Investment | Market distortions | Economic growth |

| International cooperation | Stifled competition | Prosperity |

Moving on to the next subtopic, increased consumer choices…

Increased Consumer Choices

Engaging in international commerce broadens the range of consumer choices available to us. Through increased competition and market expansion, trade creates a dynamic environment where innovative products and services thrive. When countries trade with one another, they bring in goods and services that may not be available domestically. This leads to a greater variety of options for consumers, allowing them to choose from a wider range of products that suit their preferences and needs.

Additionally, trade encourages businesses to continuously improve and innovate in order to stay competitive in the global market. This competition drives advancements in technology, design, and quality, resulting in better products and services for consumers worldwide.

As we explore the benefits of increased consumer choices, it becomes clear how trade fosters innovation and drives economic growth. This lays the foundation for international cooperation and peace as nations come together to explore mutually beneficial trade relationships.

International Cooperation and Peace

As we explore the benefits of increased consumer choices, it becomes evident that international cooperation and peace are fostered through trade and its numerous advantages.

International cooperation is essential for economic development as it allows countries to specialize in the production of goods and services in which they’ve a comparative advantage. By engaging in trade, countries can access a wider range of products and resources, leading to increased efficiency and productivity.

This cooperation also promotes peace by creating mutually beneficial relationships and reducing the likelihood of conflicts. Trade encourages diplomacy and collaboration, as nations realize the interdependence and shared interests that arise from economic exchange.

As we delve further into Ricardo’s insights on specialization, we’ll see how these principles further enhance international cooperation and promote global prosperity.

Ricardo’s Insights on Specialization

In our pursuit of understanding Ricardo’s insights on specialization, we delve into the importance of identifying the double preposition in his theory of comparative advantage. Ricardo’s contributions to economic theory revolutionized our understanding of international trade and specialization.

His theory of comparative advantage argues that countries should focus on producing goods and services in which they have a lower opportunity cost compared to other nations. By specializing in these areas, countries can increase their overall efficiency and productivity, leading to economic growth and prosperity.

Ricardo’s insights on specialization are crucial in today’s world, where global trade plays a significant role in the economy. The identification of the double preposition in his theory highlights the importance of understanding the underlying principles of specialization. It emphasizes that countries shouldn’t just focus on what they’re good at producing, but also on the relative cost of producing certain goods and services.

This understanding allows for more precise decision-making in terms of resource allocation and trade policies. By embracing Ricardo’s insights on specialization, countries can harness their unique strengths and advantages, leading to increased innovation and competitiveness. Specialization promotes the exchange of goods and knowledge, fostering a collaborative environment where ideas can flourish.

In this way, Ricardo’s theory continues to inspire and guide us towards a future of economic growth and prosperity through specialization.

The Role of Opportunity Cost

Continuing our exploration of Ricardo’s insights on specialization, let’s now delve into the role of opportunity cost. Understanding opportunity cost is crucial for making informed decisions about resource allocation and maximizing productivity. Here are three key points to consider:

- Trade-offs: Opportunity cost refers to the value of the next best alternative that’s forgone when a choice is made. In the context of specialization, individuals or nations must weigh the benefits of producing one good or service against the costs of not producing another. This trade-off allows for the efficient allocation of resources.

- Role of Investment: Opportunity cost also plays a significant role in determining the allocation of investment. By considering the potential returns and opportunity costs of different investment options, individuals and firms can make strategic decisions to enhance productivity and innovation.

- Impact on Income Distribution: Specialization based on comparative advantage can have implications for income distribution. As resources are allocated to industries where a country has a comparative advantage, it can lead to the growth of those industries, resulting in higher income and job opportunities for individuals involved.

Understanding the role of opportunity cost in specialization helps us recognize the importance of efficient resource allocation and strategic decision-making. By considering trade-offs, investments, and income distribution, we can harness the benefits of specialization to drive innovation and economic growth.

Now, let’s explore how international trade and economic growth are interconnected.

International Trade and Economic Growth

Let’s dive into how international trade fosters economic growth. Comparative advantage plays a crucial role in the process of economic development. When countries specialize in producing goods and services that they have a comparative advantage in, it leads to increased efficiency and productivity. This specialization allows countries to allocate their resources more effectively, resulting in higher output and economic growth.

Trade liberalization also plays a significant role in promoting economic growth. By reducing barriers to trade, such as tariffs and quotas, countries can increase their access to global markets. This leads to increased competition, which encourages firms to become more innovative and efficient in order to remain competitive. As a result, trade liberalization stimulates economic growth by driving productivity improvements and technological advancements.

Moreover, international trade has been instrumental in poverty reduction. By expanding markets and creating employment opportunities, trade has the potential to lift people out of poverty. It allows countries to tap into global demand and generate income through exports. Additionally, trade provides consumers with access to a wider range of goods at lower prices, improving their standard of living.

Critiques of Ricardo’s Theory

How can we question Ricardo’s theory of comparative advantage?

While Ricardo’s theory is widely accepted and has been influential in shaping international trade policies, it isn’t without its critics. Let’s explore some of the critiques and limitations of Ricardo’s theory:

- Overemphasis on static analysis:

One criticism of Ricardo’s theory is its focus on static comparative advantage. Critics argue that this approach fails to account for dynamic changes and shifts in comparative advantage over time. In a rapidly changing global economy, the assumption of fixed comparative advantage may not hold true. - Ignoring distributional effects:

Critics also argue that Ricardo’s theory doesn’t take into account the distributional impacts of trade. While trade can lead to aggregate gains, it may also result in winners and losers within a country. This can create social and political tensions that aren’t adequately addressed by the theory. - Assumption of perfect competition:

Another limitation is the assumption of perfect competition, which may not hold true in the real world. In reality, markets are often characterized by imperfect competition, barriers to entry, and unequal access to resources. These factors can undermine the assumptions of Ricardo’s theory.

It is important to critically evaluate Ricardo’s theory and its limitations to ensure that our understanding of comparative advantage remains relevant in an ever-changing global economy. By acknowledging these critiques, we can strive for innovation in trade theories and policies that better address the complexities of international trade.

The Relevance of Comparative Advantage Today

Comparative advantage remains a crucial concept in today’s global economy. In the era of globalization, where countries are increasingly interconnected and trade barriers are being reduced, understanding comparative advantage is more important than ever. This concept highlights the efficiency gains that can be achieved when countries specialize in producing goods or services in which they’ve a lower opportunity cost compared to other countries.

One of the key reasons why comparative advantage is relevant in today’s world is its impact on developing countries. Globalization has created new opportunities for these countries to participate in international trade and benefit from their comparative advantages. By specializing in industries where they’ve a natural advantage, such as low-cost labor or abundant natural resources, developing countries can attract foreign investment, create jobs, and accelerate their economic growth.

Moreover, comparative advantage allows for the efficient allocation of resources on a global scale. By focusing on producing goods or services where they’ve a comparative advantage, countries can maximize their production efficiency and overall welfare. This leads to increased innovation, productivity, and competitiveness in the global marketplace.

In conclusion, the relevance of comparative advantage in today’s global economy can’t be overstated. Its role in promoting efficient resource allocation, fostering international trade, and driving economic growth, particularly in developing countries, makes it a fundamental concept for understanding and navigating the complexities of the modern world.

In the following section, we’ll explore concrete examples of comparative advantage in practice, further illustrating its importance in the global economy.

Examples of Comparative Advantage in Practice

Real-world examples of comparative advantage highlight the practical benefits of this economic concept. When countries specialize in producing goods and services in which they have a comparative advantage, it leads to increased global trade and economic growth.

By focusing on their strengths and trading with other nations, countries can achieve higher levels of efficiency and productivity, ultimately benefiting both producers and consumers.

These examples demonstrate the relevance and effectiveness of comparative advantage in driving economic success.

Real-World Comparative Advantages

We have observed numerous examples of comparative advantage being successfully applied in real-world scenarios. In today’s globalized economy, global supply chains have become a key driver of competitive advantage for businesses.

Here are three examples of real-world comparative advantages:

- Apple Inc: Apple leverages its comparative advantage by designing its products in the United States, while manufacturing them in countries like China and Taiwan, where labor costs are lower. This allows them to maintain a competitive edge in terms of cost-efficiency.

- Toyota: Toyota has a comparative advantage in lean manufacturing processes, enabling them to produce high-quality vehicles at a lower cost compared to their competitors. This has helped them become one of the world’s leading automakers.

- Costa Rica: Costa Rica has successfully positioned itself as a hub for outsourcing services, particularly in the fields of customer support and software development. The country’s skilled workforce, coupled with lower labor costs, gives it a comparative advantage in these industries.

These examples demonstrate how businesses and countries can leverage their comparative advantages to achieve success in the global marketplace.

Global Trade Benefits

Global trade benefits can be seen through the practical application of comparative advantage. International trade plays a crucial role in economic growth by allowing countries to specialize in the production of goods and services they’ve a comparative advantage in. This leads to increased efficiency, productivity, and innovation, ultimately benefiting both trading partners.

For example, a country with a favorable climate for agriculture may have a comparative advantage in producing crops, while another country with advanced manufacturing capabilities may have a comparative advantage in producing machinery. By trading these goods, both countries can maximize their resources and achieve higher levels of economic growth.

Additionally, global trade benefits extend beyond economic gains. It promotes cultural exchange, fosters diplomatic ties, and encourages peace and cooperation among nations.

Specialization and Efficiency

How can specialization and efficiency be exemplified through comparative advantage?

Specialization and efficiency are key concepts in understanding how countries can benefit from comparative advantage. By focusing on producing goods and services in which they have a lower opportunity cost, countries can achieve efficiency gains and increase their overall productivity.

Here are three examples of how specialization and efficiency can be demonstrated through comparative advantage:

- Resource allocation: Countries can allocate their scarce resources more effectively by specializing in the production of goods and services for which they have a comparative advantage. This allows them to maximize their output and utilize their resources efficiently.

- Economies of scale: Specializing in a particular industry allows countries to take advantage of economies of scale. By producing a larger quantity of a specific good or service, countries can reduce their average costs and increase their efficiency.

- Innovation and technological advancements: Trade specialization encourages countries to focus on industries where they have a comparative advantage. This promotes innovation and technological advancements, leading to increased productivity and overall economic growth.

The Legacy of Ricardo’s Contributions

The legacy of Ricardo’s contributions remains significant in shaping our understanding of comparative advantage. Ricardo’s impact on the field of economics can’t be overstated. His theories revolutionized the way we think about international trade and specialization. His concept of comparative advantage, which states that countries should specialize in producing goods and services in which they’ve a lower opportunity cost, has had a profound influence on economic policy and trade theory.

Ricardo’s theories challenged prevailing beliefs at the time and provided a new framework for analyzing trade patterns and economic growth. By emphasizing the benefits of specialization and trade, Ricardo’s work laid the foundation for modern theories of globalization and international economics. His ideas continue to shape our understanding of how countries can maximize their economic potential through trade and specialization.

The legacy of Ricardo’s contributions extends beyond the realm of economics. His theories have inspired further research and innovation in fields such as industrial organization and development economics. By highlighting the importance of comparative advantage, Ricardo’s work encourages countries to focus on their areas of strength and to engage in mutually beneficial trade relationships.

Frequently Asked Questions

How Did Ricardo Develop the Concept of Comparative Advantage?

Ricardo’s contributions to economic theory include the development of the concept of comparative advantage. Through analytical thinking and logical reasoning, he demonstrated how countries could benefit from specializing in the production of goods they have a lower opportunity cost in producing.

What Are the Main Benefits of Trade According to Ricardo?

The main benefits of trade, according to Ricardo, are increased efficiency, specialization, and economic growth. By championing the concept of comparative advantage, he highlighted how countries can mutually benefit by focusing on producing what they do best.

How Did Ricardo’s Insights on Specialization Shape Economic Thinking?

Ricardo’s insights on specialization revolutionized economic thinking by highlighting the impact of specialization on economic development. His ideas shaped our understanding of the role specialization plays in driving innovation, increasing productivity, and fostering global trade.

What Is the Role of Opportunity Cost in Comparative Advantage?

Opportunity cost in trade plays a crucial role in comparative advantage. By efficiently allocating resources, countries can specialize in producing goods with lower opportunity costs, leading to increased productivity and innovation in the global market.

How Does International Trade Contribute to Economic Growth According to Ricardo?

International trade contributes to economic growth according to Ricardo by promoting specialization and taking advantage of differences in opportunity cost. This allows countries to focus on producing goods and services they have a comparative advantage in, leading to increased efficiency and innovation.

Conclusion

In conclusion, Ricardo championed the concept of comparative advantage because he recognized its power to drive economic growth and enhance international trade.

Through his insights on specialization and the role of opportunity cost, Ricardo paved the way for countries to effectively allocate their resources and maximize their efficiency.

Today, comparative advantage remains relevant as it enables nations to capitalize on their unique strengths, fostering cooperation and prosperity in the global marketplace.

Ricardo’s legacy continues to shape our understanding of trade and its benefits.

Lauren’s talent in writing is matched by her passion for storytelling. Her love for books and deep understanding of culture and entertainment add a distinct flavor to her work. As our media and press contact, Lauren skillfully bridges the gap between afterQuotes and the broader media landscape, bringing our message to a wider audience.