Ever thought about why certain countries are able to excel in the production of specific goods, while others face difficulties?

Well, let me tell you about what Ricardo said about comparative advantage!

Imagine a scenario where Country A can produce both cars and computers, but at a higher cost than Country B. However, Country A is still better at producing cars compared to computers.

According to Ricardo, each country should specialize in producing the goods in which it has a comparative advantage, and then trade with other countries for the goods they lack efficiency in producing.

This concept of comparative advantage allows for increased productivity, innovation, and economic growth.

So, join me as we delve into Ricardo’s theory and discover how it revolutionized the world of international trade!

Key Takeaways

- Comparative advantage explains how nations can benefit from specializing in the production of goods and services in which they have a lower opportunity cost compared to other nations.

- Trade is essential for countries to obtain goods or services that they cannot produce efficiently, leading to increased productivity and economic growth.

- Specialization leads to increased efficiency and productivity, driving innovation and development, and promoting collaboration and exchange of ideas.

- The role of government is crucial in promoting comparative advantage through policies that support industries, subsidies, infrastructure improvements, and investment in education and research and development.

Definition of Comparative Advantage

The definition of comparative advantage is an economic concept that explains how nations can benefit from specializing in the production of goods and services in which they have a lower opportunity cost compared to other nations. This concept is based on the idea that countries should focus on producing goods or services that they can produce at a lower cost than other countries, and then trade with other nations to obtain goods or services that they cannot produce as efficiently.

There are several advantages of comparative advantage. First, it allows countries to allocate their resources more efficiently, as they can focus on producing goods or services in which they have a comparative advantage. This leads to increased productivity and economic growth. Second, comparative advantage promotes specialization, which leads to economies of scale and increased efficiency in production. This can result in lower costs and increased competitiveness in the global market.

However, there are also limitations to comparative advantage. One limitation is that it assumes constant opportunity costs, which may not always be the case in reality. Additionally, comparative advantage does not take into account factors such as technological advancements or government policies, which can impact a country’s ability to compete in certain industries.

Importance of Specialization

Continuing from our previous discussion on the benefits of comparative advantage, let’s now explore the importance of specialization in driving economic growth and innovation.

Specialization refers to the practice of individuals, businesses, or countries focusing on specific tasks or areas of expertise. It allows for the advantages of division of labor, where each individual or entity can concentrate on what they do best, leading to increased efficiency and productivity.

One of the key advantages of specialization is economic efficiency. When individuals or businesses specialize in a particular task, they become more skilled and efficient at it over time. This increased efficiency results in higher productivity and lower costs, as they’re able to produce more output with the same or fewer resources. As a result, specialization can lead to economic growth by increasing overall production and improving the allocation of resources.

Furthermore, specialization plays a crucial role in driving innovation. When individuals or businesses focus on a specific area, they’re more likely to develop deep expertise and knowledge in that field. This expertise enables them to identify and capitalize on opportunities for innovation, leading to the development of new products, processes, and technologies. Specialization promotes the exchange of ideas, collaboration, and competition, all of which are essential drivers of innovation.

Benefits of International Trade

We benefit from international trade in various ways. Here are three advantages of international trade that contribute to economic growth:

- Increased market access: International trade allows businesses to expand their customer base beyond domestic borders. By accessing new markets, companies can increase sales and revenue. This not only benefits individual businesses but also stimulates economic growth at a national level.

- Comparative advantage: International trade allows countries to specialize in the production of goods and services in which they have a comparative advantage. This means that countries can focus on producing the goods and services they are most efficient at, while importing those that can be produced more efficiently by other countries. This specialization leads to increased productivity and efficiency, driving economic growth.

- Technology transfer: International trade facilitates the exchange of ideas, knowledge, and technology between countries. Through trade, countries can learn from each other’s best practices and adopt innovative technologies. This technology transfer helps to boost productivity and competitiveness, leading to economic growth.

Criticisms of Comparative Advantage

One major criticism of comparative advantage is its assumption of constant and unchanging resource availability. While the theory suggests that countries should specialize in producing goods that they have a comparative advantage in, it fails to account for the limitations of this assumption. In reality, resource availability is not constant and can vary over time due to factors such as depletion, technological advancements, and changes in market demands.

This assumption of constant resource availability can lead to inefficiencies and missed opportunities. For example, a country that specializes in producing a certain good based on its current comparative advantage may find itself at a disadvantage if the availability of the necessary resources decreases or if new resources become available that could enhance its production capabilities. Additionally, the theory does not consider the potential for countries to develop new industries or acquire new resources through innovation and technological advancements.

To further illustrate these limitations, let’s take a look at the following table:

| Limitations of Comparative Advantage | Alternative Theories |

|---|---|

| Assumes constant resource availability | Strategic Trade Theory |

| Ignores the potential for innovation and technological advancements | New Trade Theory |

| Fails to consider changing market demands | Factor Proportions Theory |

Ricardo’s Theory of Comparative Advantage

In discussing Ricardo’s Theory of Comparative Advantage, let’s delve into the concept of specialization and its impact on international trade. Here are three key points to consider:

- Specialization leads to efficiency: According to Ricardo, countries should specialize in producing goods and services that they can produce more efficiently than other countries. This allows for the optimal allocation of resources and leads to increased productivity and economic growth.

- Limitations of comparative advantage: While comparative advantage promotes specialization and trade, it has its limitations. It assumes that resources are perfectly mobile between industries, which may not always be the case. Additionally, it doesn’t account for factors such as transportation costs, economies of scale, and technological differences, which can affect the competitiveness of industries.

- Role of government in promoting comparative advantage: Governments play a crucial role in promoting comparative advantage. They can implement policies to support industries with comparative advantage, such as providing subsidies, improving infrastructure, and investing in education and research and development.

Understanding these key aspects of Ricardo’s Theory of Comparative Advantage allows us to analyze its application in the real world. Now, let’s explore how this theory has been put into practice and the impact it has had on global trade and economic development.

Application of Comparative Advantage in Real World

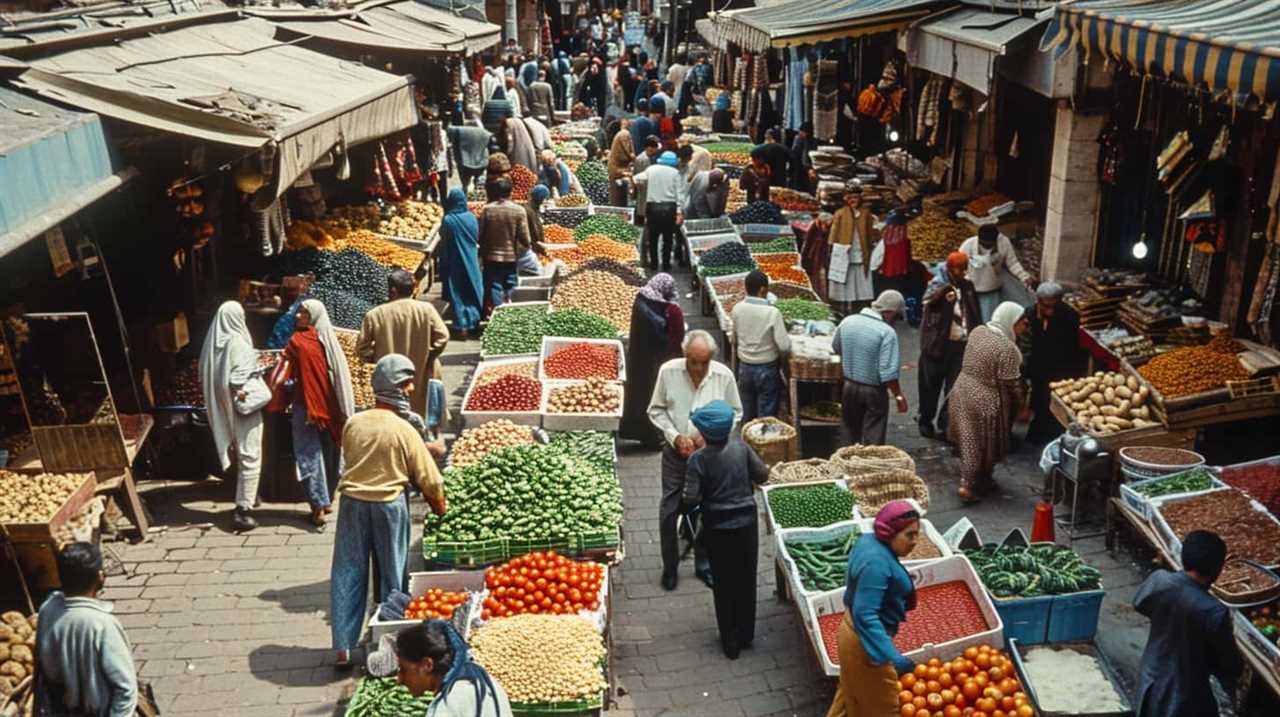

The application of comparative advantage in the real world can be seen through the specialization and trade patterns observed between countries. Countries utilize their resources and expertise to produce goods and services more efficiently and at a lower opportunity cost, leading to increased productivity and economic growth.

One way in which comparative advantage is applied in business is through outsourcing. Companies often outsource certain tasks or processes to countries where they’ve a comparative advantage in terms of cost or skill. For example, a technology company may outsource its customer service operations to a country with a large pool of skilled and cost-effective call center agents.

Another application of comparative advantage is seen in global supply chains. Companies strategically locate different stages of production in different countries to take advantage of their comparative advantages. This allows for increased efficiency and cost savings. For instance, a clothing manufacturer may have its design team in one country, its production facilities in another, and its distribution centers in yet another, each location chosen based on its comparative advantage in that particular stage of the production process.

However, the application of comparative advantage in business has also had an impact on global inequality. While it can lead to economic growth and increased prosperity, it can also exacerbate the gap between developed and developing countries. Developed countries often have a comparative advantage in high-skilled industries, while developing countries may have a comparative advantage in low-skilled labor-intensive industries. This can lead to a concentration of wealth and opportunities in developed countries, widening the global inequality gap.

Legacy of Ricardo’s Comparative Advantage Theory

To understand the legacy of Ricardo’s Comparative Advantage Theory, let’s delve into its implications for international trade and economic development.

Ricardo’s theory has had a profound impact on the global economy and continues to shape our understanding of economic growth and global competitiveness.

- Economic growth: Ricardo’s theory emphasizes the importance of specialization and trade in driving economic growth. By allowing countries to focus on producing goods and services that they’ve a comparative advantage in, resources are allocated more efficiently, leading to increased productivity and output. This has contributed to the rapid economic growth experienced by many countries over the years.

- Global competitiveness: Ricardo’s theory also highlights the benefits of international trade for enhancing a country’s global competitiveness. By specializing in the production of goods and services where they’ve a comparative advantage, countries can become more competitive in the global market. This promotes innovation, efficiency, and the development of industries that are globally competitive, ultimately leading to higher living standards.

The legacy of Ricardo’s Comparative Advantage Theory can be seen in the continued emphasis on open trade policies and the recognition of the importance of specialization and comparative advantage in driving economic growth and global competitiveness. It has provided a solid foundation for understanding and promoting international trade and economic development in today’s interconnected world.

Frequently Asked Questions

How Did Ricardo’s Theory of Comparative Advantage Impact Economic Thinking in the 19th Century?

Ricardo’s theory of comparative advantage, with its impact on trade policy and role in globalization, revolutionized economic thinking in the 19th century. It paved the way for efficient allocation of resources and fostered international cooperation.

What Are Some Real-World Examples of Countries Benefiting From Comparative Advantage?

Real-world examples showcase the benefits of comparative advantage, like a symphony where each country plays its unique instrument. Specializing in what we do best allows us to harmonize with others, creating a more prosperous and innovative global economy.

Are There Any Limitations or Drawbacks to the Theory of Comparative Advantage?

There are limitations and drawbacks to the theory of comparative advantage. It assumes perfect competition, neglects transportation costs, and can lead to dependency on certain industries.

How Does Specialization Contribute to Economic Growth?

Specialization contributes to economic growth by increasing efficiency and trade benefits. It allows us to focus on what we do best, resulting in higher productivity and innovation. This leads to a stronger economy and improved living standards for all.

What Are Some Alternative Theories to Comparative Advantage in International Trade?

Alternative theories to comparative advantage in international trade include the factor proportions theory, the new trade theory, and the strategic trade theory. Critiques and limitations of comparative advantage focus on its assumptions and applicability in certain industries.

Conclusion

In conclusion, Ricardo’s theory of comparative advantage revolutionized the way we understand international trade. By emphasizing the benefits of specialization and the importance of countries focusing on their areas of expertise, Ricardo showed that all countries can benefit from engaging in trade.

Despite criticisms, his theory remains highly influential and continues to shape global trade policies. Ricardo’s insights are so impactful that they could be considered the ‘holy grail’ of economics.

Lauren’s talent in writing is matched by her passion for storytelling. Her love for books and deep understanding of culture and entertainment add a distinct flavor to her work. As our media and press contact, Lauren skillfully bridges the gap between afterQuotes and the broader media landscape, bringing our message to a wider audience.