Just how did Steve Jobs’ passion transform industries and inspire millions? Discover the remarkable story behind his revolutionary impact.

The Latest

Napoleon Bonaparte: A Leader Is a Dealer in Hope

Fascinated by Napoleon’s inspiring leadership, discover how hope became his most powerful tool in shaping history and inspiring others.

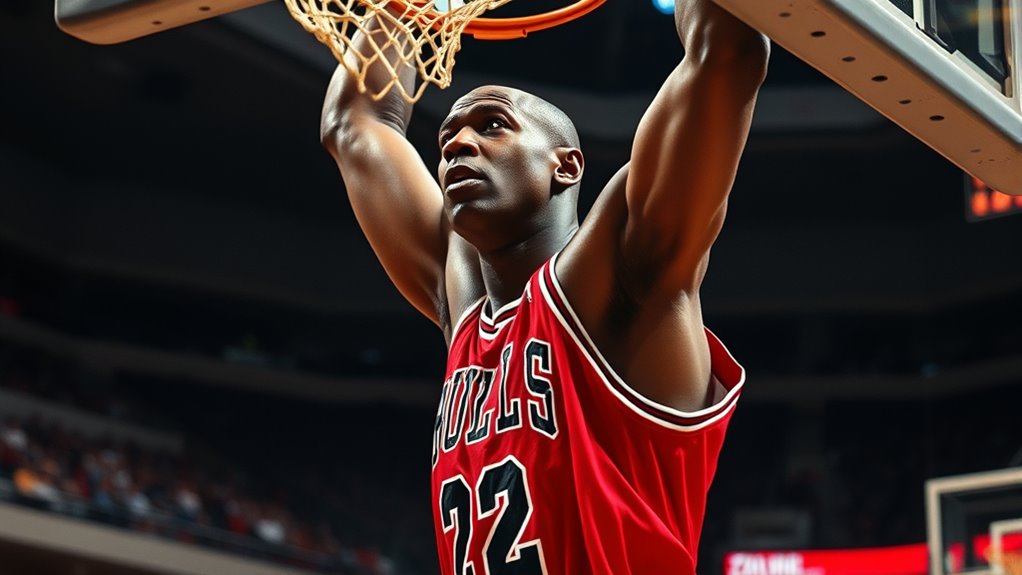

Michael Jordan: Earned Leadership Through Hard Work and Consistency

Harness the inspiring story of Michael Jordan’s earned leadership through relentless effort and consistency—discover how his approach can elevate your own path to greatness.

Jack Welch: Before You Become a Leader, Success Is All About Growing Yourself

To succeed as a leader, you need to focus on growing yourself…

It Seduces Smart People Into Thinking They Can’t Lose

Lured by their own intellect, smart people often believe they can’t lose, but understanding the hidden risks can change everything.

Bill Gates: Success Is a Lousy Teacher

Ongoing success often blinds us to lessons learned from failure—discover how Bill Gates’s experience can reshape your understanding of achievement.

Oprah Winfrey: Turn Your Wounds Into Wisdom and Lead With Empathy

Transform your wounds into wisdom and lead with empathy—discover how Oprah Winfrey’s journey can inspire your own path to resilience and connection.

A Great Leader Inspires People to Have Confidence in Themselves

A great leader inspires confidence in others by showing genuine care and…

Eleanor Roosevelt: A Good Leader Inspires People to Have Confidence in the Leader

With her genuine empathy and unwavering integrity, Eleanor Roosevelt exemplifies how true leadership inspires lasting confidence—discover what made her a legendary leader.

Arnold Glasow: One of the Tests of Leadership Is the Ability to Recognize a Problem Before It Becomes an Emergency

Leadership hinges on spotting problems early; learn how recognizing issues before they escalate can transform your management approach and…