Do you find yourself fascinated by the logic underlying Ricardo’s theory of comparative advantage in classical economics? Come along with us as we embark on a journey of discovery into the profound insights of this esteemed economist.

In our quest for innovation, we will unravel the complexities of comparative advantage and its application in trade. With an active voice and a first-person plural perspective, we aim to captivate an audience that desires fresh perspectives and groundbreaking ideas.

Together, let us challenge and unpack the theory put forth by David Ricardo, shedding light on its relevance in the modern world. So, are you ready to embark on this intellectual adventure? Let’s uncover the secrets of Ricardo’s comparative advantage and unveil the possibilities that lie within.

Key Takeaways

- Classical economics emerged as a dominant school of thought, with David Ricardo being one of its key figures.

- David Ricardo made notable contributions to economic theory, including the concepts of comparative advantage and Ricardian equivalence.

- Comparative advantage refers to the ability of countries to benefit from specialization and allocating resources based on lower opportunity cost.

- Ricardo’s theory emphasizes the importance of international trade, increased efficiency and productivity, and overall welfare through comparative advantage.

Classical Economics: an Overview

In our exploration of Classical Economics, we’ll provide a concise overview of its principles and theories.

Classical Economics is a school of thought that emerged in the late 18th century and dominated economic thinking until the mid-19th century. It was characterized by a focus on free markets, limited government intervention, and the belief in the self-regulating nature of the economy. The key figures in classical economics include Adam Smith, David Ricardo, and John Stuart Mill.

One of the central tenets of classical economics is the concept of the invisible hand, which suggests that individuals pursuing their own self-interest in a competitive market will unintentionally promote the overall well-being of society. This idea emphasizes the importance of free trade and the market’s ability to allocate resources efficiently. Another significant principle is the labor theory of value, which posits that the value of a good is determined by the amount of labor required to produce it.

Classical economists also believed in the long-run equilibrium of the economy, where prices and wages adjust to ensure full employment and stable prices. They argued against government interference in the economy, advocating for minimal regulation and a laissez-faire approach.

David Ricardo: a Prominent Economist

Often, we find David Ricardo to be a prominent economist in Classical Economics. His contributions to economic theory have shaped and influenced the field in significant ways. Let’s delve into three key reasons why Ricardo’s prominence in economics is worth exploring:

- Comparative Advantage: Ricardo’s most notable contribution to economic theory is the concept of comparative advantage. He argued that countries should specialize in producing goods in which they’ve a lower opportunity cost, and engage in international trade to maximize overall welfare. This idea revolutionized the understanding of trade patterns and laid the foundation for modern trade theory.

- Labor Theory of Value: Ricardo expanded upon Adam Smith’s labor theory of value, proposing that the value of a good is determined by the amount of labor required for its production. This theory challenged the prevailing viewpoints of his time and continues to be a subject of debate and analysis.

- Ricardian Equivalence: Another significant contribution by Ricardo is the concept of Ricardian equivalence, which suggests that the method of financing government spending doesn’t affect aggregate demand. This idea has implications for fiscal policy and has been widely discussed in macroeconomic literature.

David Ricardo’s prominence in economics is evident through these impactful contributions to economic theory. By understanding and studying his ideas, we can gain valuable insights into the foundations of classical economics and continue to innovate in the field.

Understanding Comparative Advantage

Our exploration of Ricardo’s prominence in economics continues as we delve into the concept of comparative advantage in classical economics. Comparative advantage is a fundamental principle in economic theory that explains how countries can benefit from specializing in the production of goods and services in which they have a lower opportunity cost.

According to Ricardo, countries should allocate their resources and focus on producing goods and services that they can produce at a lower opportunity cost compared to other countries. This allows for increased efficiency and productivity, leading to economic growth and improved living standards.

The concept of comparative advantage challenges the traditional notion of self-sufficiency and promotes international trade as a means of maximizing overall welfare. By specializing in the production of goods and services that they have a comparative advantage in, countries can trade with each other and mutually benefit from the exchange.

This theory has important implications for global trade and globalization. It highlights the importance of open markets and the free flow of goods and services across borders. By embracing comparative advantage, countries can tap into their unique strengths and capabilities, fostering innovation and specialization.

Ricardo’s Theory of Comparative Advantage

To fully grasp the concept of Ricardo’s Theory of Comparative Advantage, we must delve into the principles of international trade and specialization. This theory, put forth by economist David Ricardo in the early 19th century, revolutionized the understanding of how countries can benefit from trade. However, it’s important to consider the limitations of this theory and its historical context.

- Limitations of the Theory

- While Ricardo’s theory assumes that resources are fully mobile between industries, in reality, factors like transportation costs and trade barriers can limit this mobility.

- The theory also assumes constant returns to scale, which means that increasing production doesn’t lead to increasing costs. However, in reality, economies of scale and diseconomies of scale can affect production costs.

- Ricardo’s theory focuses on comparative advantage based on labor productivity, but it doesn’t consider other factors such as technological advancements or natural resource endowments.

- Historical Context

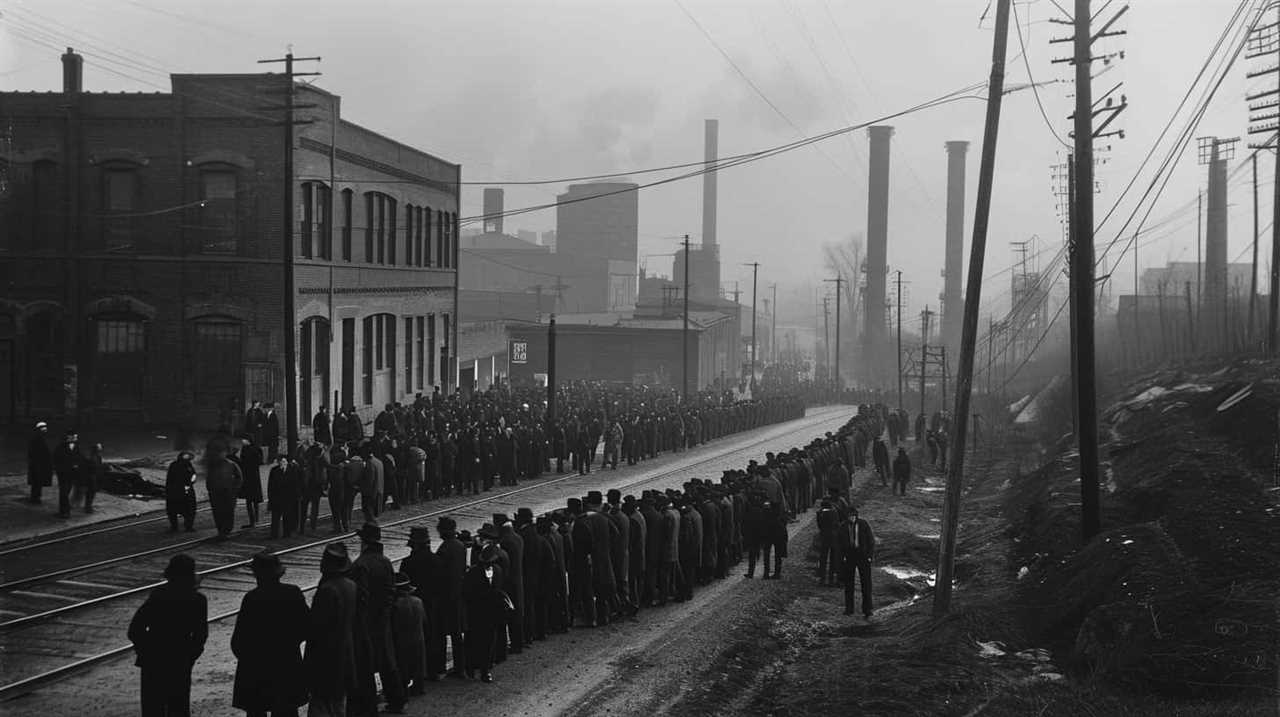

- Ricardo developed his theory in an era characterized by the Industrial Revolution and rapid technological advancements. This context shaped his understanding of trade and specialization.

- The theory emerged during a time when countries were increasingly engaging in international trade and seeking ways to maximize their gains from specialization.

- Ricardo’s theory provided a framework for policymakers to evaluate the benefits of free trade and to understand the importance of specialization in economic growth.

Understanding the limitations of Ricardo’s Theory of Comparative Advantage and considering its historical context allows us to critically analyze its applicability in modern economies and explore alternative approaches to international trade and specialization.

Application of Comparative Advantage in Trade

When it comes to the application of comparative advantage in trade, there are several key points to consider.

Firstly, specialization allows countries to focus on producing goods and services in which they have a comparative advantage. This leads to increased efficiency and productivity.

Secondly, trade-offs are an inherent aspect of comparative advantage. Countries may have to forgo producing certain goods in order to specialize in others. This can result in some industries shrinking or even disappearing in certain countries.

Lastly, the concept of comparative advantage promotes global economic interdependence. Countries engage in trade to maximize their gains from specialization. This interdependence means that no country can be self-sufficient and must rely on others for certain goods and services.

Benefits of Specialization

As we delve into the exploration of Ricardo’s Comparative Advantage in Classical Economics, it becomes evident that the application of comparative advantage in trade brings forth numerous benefits through specialization.

Specialization benefits include:

- Increased economic efficiency: By focusing on producing goods and services where a country has a comparative advantage, resources are allocated more efficiently. This leads to higher productivity and output, ultimately boosting economic growth.

- Expanded market access: Specialization allows countries to produce goods and services at a lower cost, making them more competitive in the global market. This opens up opportunities for trade and increases market access, leading to increased exports and economic prosperity.

- Technological innovation: Specialization encourages countries to invest in research and development, leading to technological advancements. This not only enhances productivity but also drives innovation, creating new industries and driving economic progress.

Trade-Offs in Comparative Advantage

Weighing the trade-offs is essential when applying comparative advantage in trade. Trade-offs refer to the sacrifices or costs that must be made in order to pursue a particular course of action.

In the context of comparative advantage, trade-offs arise due to the concept of opportunity cost. When a country specializes in producing goods or services in which it has a comparative advantage, it gains from trade by focusing its resources on those areas. However, this specialization comes at the expense of producing other goods or services where it may not have a comparative advantage.

Therefore, trade-offs in comparative advantage involve sacrificing the production of certain goods or services in order to maximize the benefits from trade. By carefully considering these trade-offs, countries can optimize their resource allocation and enhance their overall welfare through international trade.

Global Economic Interdependence

Frequently, we benefit from global economic interdependence through the application of comparative advantage in trade. The impact of globalization has brought about a number of advantages and opportunities for countries and individuals alike.

Here are three key ways in which global economic interdependence has shaped our world:

- Increased access to a diverse range of goods and services from different parts of the world, allowing consumers to enjoy a wider selection and higher quality products.

- Enhanced efficiency and productivity through specialization and exchange, as countries focus on producing goods and services in which they’ve a comparative advantage.

- Promotion of economic growth and development, as countries engage in trade and investment, leading to the transfer of knowledge, technology, and capital.

These factors have contributed to the interconnectedness of our global economy, fostering innovation and providing opportunities for collaboration and growth.

The application of comparative advantage in trade has played a crucial role in harnessing the benefits of global economic interdependence.

Critiques and Modern Interpretations

Critiques and modern interpretations of Ricardo’s comparative advantage theory present a nuanced understanding of its application in contemporary economics.

From a modern perspective, economists have highlighted the limitations of the theory, such as its assumption of constant returns to scale and the assumption of full employment.

Additionally, Ricardo’s legacy today extends beyond trade theory, as his ideas have influenced various fields, including international economics, development economics, and economic growth theories.

Understanding these critiques and modern interpretations allows for a more comprehensive analysis of the continued relevance and applicability of Ricardo’s comparative advantage theory.

Modern Economic Perspectives

In our exploration of Ricardo’s Comparative Advantage in Classical Economics, we examine modern economic perspectives and their critiques and modern interpretations. Economic globalization and free trade agreements have significantly shaped the way we understand and practice international trade today. Here are three key aspects to consider:

- The impact of economic globalization on income distribution: Critics argue that globalization has led to income inequality, as it benefits the wealthy and leaves the working class behind.

- The role of free trade agreements in promoting economic growth: Supporters argue that free trade agreements can lead to increased productivity, innovation, and overall economic growth.

- The need for a balanced approach to globalization: Many economists advocate for a balanced approach that considers both the advantages and disadvantages of economic globalization and free trade agreements, in order to create policies that address the concerns of all stakeholders.

Limitations of Comparative Advantage

Exploring the limitations of comparative advantage reveals the complexities and challenges faced in applying this economic principle in practice.

While comparative advantage is a fundamental concept in classical economics, it hasn’t been without its criticisms. One limitation is the assumption of constant costs, which may not hold in reality due to factors such as technological advancements or changes in resource availability.

Additionally, comparative advantage doesn’t consider the distributional impacts of trade, as certain industries or regions may be negatively affected by increased competition. Critics argue that comparative advantage can lead to job displacement and income inequality, particularly in industries with low-skilled labor.

Furthermore, the rise of global value chains and the increasing importance of services trade have raised questions about the relevance and applicability of comparative advantage in the modern global economy.

These criticisms and limitations highlight the need for a more nuanced understanding and application of comparative advantage in order to address the challenges and complexities of today’s economic landscape.

Ricardo’s Legacy Today

How does Ricardo’s legacy continue to shape modern interpretations and critiques of comparative advantage in classical economics?

- Ricardo’s insights remain relevant: Despite being over two centuries old, Ricardo’s theory of comparative advantage continues to be a cornerstone of classical economics. Its enduring legacy lies in its ability to explain the benefits of specialization and trade between nations.

- Expanding global economic interdependence: In today’s interconnected world, Ricardo’s ideas have gained even greater significance. As countries become increasingly interdependent through trade and investment, the concept of comparative advantage helps us understand the dynamics of global economic relationships.

- Critiques and adaptations: While Ricardo’s theory remains influential, it has faced some criticisms and adaptations. Modern interpretations have focused on refining and expanding the concept, considering factors like technology, government intervention, and income distribution. These critiques contribute to a more nuanced understanding of comparative advantage in the contemporary economic landscape.

Ricardo’s legacy today continues to shape our understanding of global economic interdependence, providing insights into the benefits of specialization and trade while also inspiring ongoing critiques and adaptations to meet the challenges of the modern world.

Frequently Asked Questions

How Does Classical Economics Differ From Other Economic Theories?

In classical economics, we see a distinction from other economic theories such as neoclassical economics. Classical economics focuses on key principles like the labor theory of value and the importance of comparative advantage.

What Were Some of David Ricardo’s Other Contributions to Economics?

David Ricardo made significant contributions to economics, with his theories on comparative advantage having a lasting impact. His insights revolutionized trade theory and provided a foundation for understanding the benefits of specialization and international trade.

Can You Explain the Concept of Comparative Advantage Using a Real-World Example?

We can understand the concept of comparative advantage by looking at real-world examples. It is the ability of a country or individual to produce a good or service at a lower opportunity cost than others, leading to efficient international trade.

How Has the Theory of Comparative Advantage Been Applied in International Trade?

The theory of comparative advantage has significant implications for economic development and highlights the role of government in promoting it. By specializing in areas of comparative advantage, countries can maximize productivity and foster innovation in international trade.

What Are Some Common Criticisms of Ricardo’s Theory of Comparative Advantage and How Have Modern Economists Addressed Them?

Critiques of comparative advantage have been raised, but modern economists have addressed them. They argue that Ricardo’s theory oversimplifies reality, fails to consider dynamic comparative advantage, and assumes full employment.

What Is the Connection Between Ricardo’s Comparative Advantage and Economic Trade Principles?

Ricardo’s trade principles economics shape the foundation of comparative advantage in international trade. His theory suggests that countries should specialize in producing goods and services where they have a lower opportunity cost. This allows for more efficient resource allocation and promotes economic growth through trade.

Conclusion

In conclusion, Ricardo’s theory of comparative advantage remains a crucial concept in classical economics. It highlights the importance of specialization and trade for economic growth and efficiency.

One interesting statistic to note is that according to the World Trade Organization, global merchandise trade grew by 10.7% in 2021, indicating the continued relevance and impact of comparative advantage in today’s interconnected global economy.

This theory serves as a foundation for understanding the benefits of international trade and the potential for mutual gains among nations.

Lauren’s talent in writing is matched by her passion for storytelling. Her love for books and deep understanding of culture and entertainment add a distinct flavor to her work. As our media and press contact, Lauren skillfully bridges the gap between afterQuotes and the broader media landscape, bringing our message to a wider audience.