Exploring the wisdom of Ben Bernanke, the past Chairman of the Federal Reserve in the United States, reveals a wealth of knowledge about economic balance, fiscal strategy, financial turmoil, leadership qualities, inflation trends, interest rate decisions, and the role of governmental action.

With his vast knowledge and experience, Bernanke's quotes offer invaluable perspectives on these crucial areas that shape our global economy. Stepping into his shoes, we navigate through his profound words, providing a glimpse into the mind of a leader who steered the nation through turbulent times.

From his measured approach to tackling economic challenges to his thoughts on the role of government, Bernanke's quotes offer a unique and informed perspective that continues to resonate in the world of finance.

Key Takeaways

- Bernanke believes that proactive policies and a comprehensive understanding of the economy are crucial for achieving economic stability.

- He emphasizes the importance of government intervention in promoting economic stability and preventing financial crises.

- Bernanke advocates for a data-driven approach to monetary policy, closely monitoring inflation indicators and interest rates to guide economic behavior.

- His actions during the financial crisis, such as implementing unconventional policy measures and providing liquidity to distressed financial institutions, demonstrate the importance of decisive action in stabilizing the economy and restoring confidence in the financial system.

Bernanke on Economic Stability

In analyzing economic stability, Bernanke emphasizes the importance of proactive policies and a comprehensive understanding of the underlying factors that contribute to a stable economy.

For Bernanke, economic growth is a key component of stability. He argues that sustained, long-term economic growth is necessary to create jobs, raise standards of living, and reduce poverty. To achieve this growth, Bernanke advocates for policies that promote investment, innovation, and productivity.

He believes that a strong financial sector is essential for economic stability. Bernanke stresses the importance of effective financial regulation to prevent excessive risk-taking and ensure the soundness of the banking system. He argues that a well-regulated financial system can help prevent financial crises and mitigate their impact on the broader economy.

Bernanke also highlights the need for policymakers to have a deep understanding of the complex interactions between financial markets and the real economy. This understanding allows for the implementation of targeted policies that can promote stability and support economic growth.

Bernanke on Monetary Policy

Building on his analysis of economic stability, Bernanke's perspective on monetary policy offers valuable insights into the role of central banks in managing inflation, interest rates, and overall economic growth. When it comes to the effectiveness of monetary policy, Bernanke emphasizes the importance of clear communication and transparency. He believes that central banks should clearly articulate their goals and strategies to enhance the credibility and predictability of their actions. By doing so, monetary policy becomes more effective in influencing expectations and guiding economic behavior.

Bernanke also emphasizes the importance of central bank independence in conducting monetary policy. He argues that central banks should be free from political interference in order to pursue their mandate of price stability and promote sustainable economic growth. Central bank independence allows monetary policymakers to make decisions based on economic fundamentals rather than short-term political considerations.

Additionally, Bernanke highlights the need for central banks to have a flexible and adaptable approach to monetary policy. He recognizes that economic conditions can change rapidly, and central banks must be able to respond quickly and effectively to new challenges. This includes the use of unconventional monetary policy tools, such as quantitative easing, when traditional policy measures are insufficient to stimulate economic growth.

Bernanke on Financial Crisis

During the financial crisis, Bernanke implemented a range of unconventional policy measures to stabilize the economy and prevent a complete collapse of the financial system. His solutions had a significant impact on the economy, helping to mitigate the severity of the crisis and pave the way for recovery.

Here are some of Bernanke's key actions and their effects:

- Quantitative Easing (QE): Through multiple rounds of QE, the Fed purchased large quantities of long-term securities, injecting liquidity into the financial system and lowering long-term interest rates. This stimulated borrowing and investment, supporting economic growth.

- Emergency lending programs: Bernanke established emergency lending facilities, such as the Term Auction Facility, to provide liquidity to banks and other financial institutions in distress. These programs helped stabilize financial markets and restore confidence.

- Forward guidance: Bernanke used forward guidance to provide clarity on the future path of monetary policy. By signaling that interest rates would remain low for an extended period, he aimed to encourage borrowing and investment.

- Stress tests: Bernanke introduced stress tests for banks, assessing their ability to withstand severe economic downturns. This increased transparency and confidence in the banking system.

Bernanke on Leadership

Bernanke's leadership during his tenure as Chairman of the Federal Reserve was marked by strategic decision-making and a data-driven approach to managing the economy. His leadership style was characterized by a thoughtful and deliberate approach, emphasizing transparency and open communication.

Bernanke's leadership strategies were grounded in his deep understanding of economic principles and his commitment to evidence-based policymaking.

One of Bernanke's key leadership strategies was his focus on gathering and analyzing data. He recognized the importance of having a comprehensive understanding of the economic landscape in order to make informed decisions. Under his leadership, the Federal Reserve implemented a number of initiatives to enhance data collection and analysis, including the creation of the Federal Reserve Economic Data (FRED) system.

Another aspect of Bernanke's leadership style was his ability to navigate complex and challenging situations. During the financial crisis of 2008, Bernanke demonstrated strong leadership by taking decisive action to stabilize the economy and restore confidence in the financial system. His calm and measured approach helped to mitigate the impact of the crisis and lay the foundation for economic recovery.

In addition to his strategic decision-making and data-driven approach, Bernanke also emphasized the importance of collaboration and teamwork. He fostered a culture of open dialogue and encouraged diverse perspectives, recognizing that effective leadership requires input from a variety of sources.

Bernanke on Inflation

As we shift our focus to the subtopic of 'Bernanke on Inflation', it's important to examine his analytical and data-driven perspective on this crucial economic factor. Bernanke, as the Chairman of the Federal Reserve, has extensively studied and analyzed the causes and control of inflation. Here are four key insights from Bernanke regarding inflation:

- Expectations: Bernanke emphasizes the importance of managing inflation expectations. He believes that if people anticipate higher inflation, they adjust their behavior accordingly, which can lead to a self-fulfilling prophecy.

- Money supply: Bernanke recognizes the role of money supply in driving inflation. He argues that excessive growth in the money supply can generate inflationary pressures in the economy.

- Output gap: Bernanke utilizes the concept of the output gap to assess inflationary pressures. He suggests that when the economy operates above its potential, it increases the risk of inflation.

- Monetary policy: Bernanke advocates for a proactive and data-driven approach to monetary policy. He believes that central banks should closely monitor inflation indicators and take appropriate actions to control inflation when necessary.

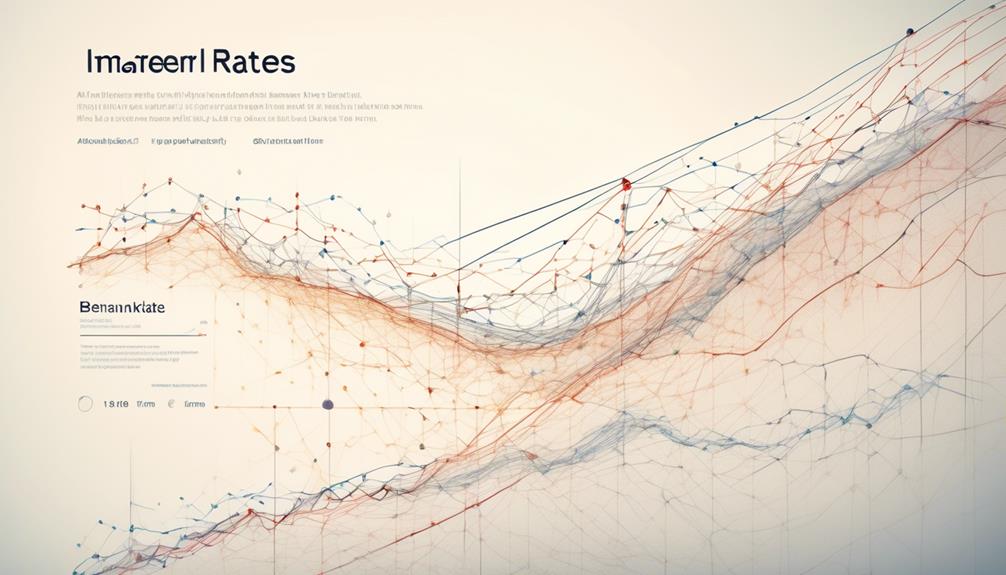

Bernanke on Interest Rates

Bernanke's analysis of interest rates reveals a data-driven and proactive approach to monetary policy. Throughout his tenure as Chairman of the Federal Reserve, Bernanke emphasized the importance of interest rates in shaping the overall state of the economy. He believed that interest rates played a crucial role in influencing consumer and business spending, investment decisions, and overall economic growth.

Bernanke's views on monetary policy were grounded in a deep understanding of economic data and trends. He closely monitored indicators such as inflation, employment figures, and GDP growth to determine the appropriate level of interest rates. By analyzing these factors, Bernanke aimed to strike a delicate balance between stimulating economic activity and maintaining price stability.

Bernanke's impact on the economy was significant, particularly during the global financial crisis of 2008. In response to the crisis, he implemented unconventional measures such as quantitative easing to lower interest rates and provide liquidity to the financial system. These actions helped stabilize markets and mitigate the severity of the economic downturn.

Bernanke on Government Intervention

Throughout his tenure as Chairman of the Federal Reserve, Ben Bernanke demonstrated a strong belief in the necessity of government intervention in times of economic crisis. Bernanke firmly believed that government regulation is essential for maintaining stability and fostering economic growth.

- Government regulation: Bernanke emphasized the importance of government oversight and regulation to prevent excessive risk-taking and potential market failures. He argued that effective regulation could help prevent future economic crises by ensuring that financial institutions adhere to prudent practices and maintain adequate capital buffers.

- Financial stability: Bernanke advocated for government intervention to stabilize the financial system during times of distress. He believed that measures such as providing liquidity support to troubled institutions and implementing stress tests were crucial for restoring confidence and preventing the collapse of the financial system.

- Countercyclical policies: Bernanke supported the use of expansionary fiscal and monetary policies during economic downturns. He believed that government intervention, in the form of fiscal stimulus and accommodative monetary policy, could help mitigate the negative impacts of recessions and promote economic recovery.

- Long-term economic growth: Bernanke recognized that government intervention is necessary to address structural issues that hinder long-term economic growth. He emphasized the importance of investing in education, research, and infrastructure to enhance productivity and competitiveness.

Bernanke on Lessons Learned

As we explore Bernanke's insights on lessons learned, we gain valuable takeaways from his experience.

Reflecting on his time as Chairman of the Federal Reserve during the financial crisis, Bernanke emphasizes the importance of proactive government intervention in stabilizing the economy.

His analysis highlights the need for policymakers to promptly respond to economic challenges and implement effective measures to mitigate the impact of future crises.

Key Takeaways

One important lesson learned from Ben Bernanke's insights is the necessity of proactive monetary policy in times of economic crisis. During his tenure as Chairman of the Federal Reserve, Bernanke emphasized the importance of taking decisive action to stimulate economic growth and stabilize financial markets. His insights highlight the role of central banking in supporting the economy and ensuring stability.

Some key takeaways from Bernanke's perspective include:

- Implementing expansionary monetary policies, such as lowering interest rates and quantitative easing, to stimulate economic activity.

- Maintaining open lines of communication with the public and financial markets to provide clarity and build confidence.

- Recognizing the interconnectedness of global economies and the need for coordinated efforts among central banks.

- Avoiding complacency and being proactive in addressing emerging risks and vulnerabilities in the financial system.

These lessons underscore the critical role of central banks in guiding the economy and mitigating the impact of economic crises.

Reflecting on Experience

Reflecting on our experience, we've gleaned valuable lessons from Ben Bernanke's tenure as Chairman of the Federal Reserve.

Bernanke's leadership during the financial crisis of 2008 showcased the importance of maintaining stability in the face of economic turmoil. His swift and decisive actions, such as implementing unconventional monetary policies and providing liquidity to financial institutions, played a crucial role in preventing a complete collapse of the global financial system.

Through this experience, we've learned the significance of proactive measures in times of crisis and the need for flexibility in monetary policy. Furthermore, Bernanke's tenure also emphasized the importance of continuous learning and personal growth. His ability to adapt to changing economic conditions and incorporate new insights into monetary policy decisions serves as a valuable lesson for future policymakers.

Frequently Asked Questions

How Did Ben Bernanke's Background and Experience Prepare Him for the Role of Chairman of the Federal Reserve?

Ben Bernanke's qualifications and economic expertise prepared us for the role of Chairman of the Federal Reserve. His background as an economist and academic, along with his experience as a former chairman of the Council of Economic Advisers, equipped him with a deep understanding of monetary policy and its impact on the economy.

Bernanke's knowledge and insights were crucial in navigating the financial crisis and implementing effective policies to stabilize the economy.

What Were Some of the Key Challenges That Bernanke Faced During His Tenure as Chairman of the Federal Reserve?

Some of the key challenges faced by Bernanke as chairman of the Federal Reserve included navigating the financial crisis of 2008, implementing monetary policy to stabilize the economy, and managing the aftermath of the crisis.

His background and experience as an economist and academic prepared him to make informed decisions.

Bernanke's leadership style differed from his predecessors, as he took a more proactive approach and advocated for government intervention in the economy.

The lessons learned from the financial crisis shaped his views on the importance of monetary policy in preventing future crises.

How Did Bernanke's Leadership Style Differ From His Predecessors at the Federal Reserve?

When examining the leadership style of Ben Bernanke, we can see distinct differences from his predecessors at the Federal Reserve.

One notable example is his approach to policy decisions. Unlike previous chairmen, Bernanke was known for his data-driven and analytical approach. He relied heavily on economic indicators and empirical evidence to inform his decisions, which garnered both praise and criticism.

This methodical and calculated style set him apart and shaped his tenure at the Federal Reserve.

What Were Some of the Key Lessons That Bernanke Learned From the Financial Crisis of 2008 and How Did They Shape His Approach to Monetary Policy?

Lessons learned from the financial crisis of 2008 had a profound impact on our approach to monetary policy.

We realized the importance of proactive measures, such as implementing unconventional policies like quantitative easing.

We also recognized the need for increased transparency and communication with the public to restore confidence in the financial system.

These lessons shaped our commitment to maintaining financial stability and promoting economic growth through targeted and data-driven policies.

How Did Bernanke's Views on Government Intervention in the Economy Evolve Throughout His Time as Chairman of the Federal Reserve?

Throughout his time as Chairman of the Federal Reserve, Bernanke's views on government intervention in the economy evolved.

The financial crisis of 2008 played a significant role in shaping his approach to monetary policy. The crisis highlighted the importance of government intervention to stabilize the economy and prevent a further collapse.

Bernanke became more supportive of aggressive measures, such as quantitative easing, to stimulate economic growth and prevent another financial crisis.

His views on government intervention shifted from cautious to proactive, reflecting the lessons learned from the crisis.

How Do Ben Bernanke’s Quotes Compare to Alan Greenspan’s Quotes as Former Chairmen of the Federal Reserve?

Ben Bernanke’s quotes as former chairman of the Federal Reserve often offer more insight into the impacts of fiscal policy, while Alan Greenspan quotes as former chairman tend to focus on the importance of market forces. Both offer valuable perspectives on economic issues.

Conclusion

In conclusion, Ben Bernanke's insightful quotes provide a compass for navigating the turbulent waters of the economy. Like a skilled captain steering a ship through treacherous seas, Bernanke's leadership and expertise guided the Federal Reserve towards economic stability.

His emphasis on monetary policy, financial crisis management, and government intervention has paved the way for lessons learned and informed decision-making. Bernanke's words are a beacon of light, illuminating the path towards a prosperous and stable future.

Joy, as our Editor in Chief, ensures the highest standard of content. Her talent in writing is complemented by her attention to detail and passion for literature and culture. Joy’s expertise and love for the English language shine through in her editorial work, making each piece a testament to quality and clarity.