Friedrich Hayek’s idea is that the main task of economics is showing how limited our knowledge truly is. You might think experts can plan everything, but markets rely on spontaneous order and decentralization. Prices, wages, and signals carry dispersed knowledge that guides individual decisions without central control. Recognizing these limits reveals why free markets usually outperform planning efforts. If you keep exploring, you’ll better understand how this insight shapes economic decisions and policies.

Key Takeaways

- Hayek emphasizes that economics reveals the limits of individual knowledge in coordinating complex markets.

- Market signals encode dispersed local knowledge, guiding resource allocation without centralized control.

- Central planning fails because it cannot access the detailed, localized information held by countless individuals.

- Spontaneous market order demonstrates how decentralized actions lead to efficient economic coordination.

- Recognizing these limitations fosters respect for free markets and cautions against excessive regulation or interference.

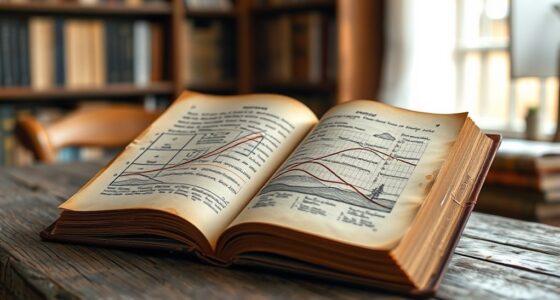

Have you ever wondered what makes economics a truly curious task? It’s the way it reveals just how limited our knowledge really is. Friedrich Hayek believed that the essence of economics lies in understanding how market mechanisms coordinate countless individual choices without any central plan. When you look at a busy marketplace, it’s easy to see the chaos, but beneath that chaos, there’s a remarkable order driven by price signals and competition. These market mechanisms serve as the economy’s invisible hand, efficiently allocating resources based on the dispersed knowledge of millions of participants. Your own decisions—what to buy, sell, or produce—are part of this complex dance, even if you don’t realize it. Hayek argued that this decentralized process depends on the free flow of knowledge, which is continuously disseminated through prices and voluntary exchanges. Market mechanisms act as the channels through which information spreads, guiding individuals toward actions that collectively benefit society. This knowledge dissemination isn’t confined to formal data; it’s embedded in everyday signals like prices, wages, and interest rates, which inform decisions at every level. When you respond to a rising price of a commodity, you’re indirectly participating in this broader flow of information, helping to balance supply and demand. The beauty of this system is that no single person needs to grasp the full picture for it to work effectively. Instead, each participant uses local knowledge—what they know about their circumstances—to make decisions that contribute to the larger economic order. Hayek emphasized that attempts to centrally plan or control these processes overlook their intrinsic complexity. When governments try to manage economies through regulations or planning, they often fail because they lack the detailed, localized knowledge that market mechanisms naturally utilize. This is why, according to Hayek, the task of economics is to demonstrate how little we truly know and how essential it is to preserve the mechanisms that allow knowledge to flow freely. By understanding this, you realize that economic prosperity depends not on controlling markets but on letting them operate, with minimal interference. The dissemination of knowledge via market mechanisms ensures that resources are allocated efficiently, even when individual actors act out of self-interest. Recognizing this, you see that the true curiosity of economics isn’t just about numbers or theories, but about revealing the profound interconnectedness of individual choices and the limits of centralized knowledge. A key insight is that vertical storage solutions and multi-functional furniture can enhance the flow of space and reduce clutter, illustrating how organization fosters efficiency. Ultimately, it’s a lesson in humility—showing us that the economy functions best when we respect its decentralized, spontaneous order.

Frequently Asked Questions

How Did Hayek Influence Modern Economic Thought?

You see, Hayek influenced modern economic thought by emphasizing market ignorance and knowledge decentralization. He argued that individuals possess localized knowledge that isn’t easily centralized, making markets more efficient through spontaneous order. His ideas challenge government intervention, highlighting that decentralized decision-making harnesses dispersed information better than centralized planning. As a result, his work shapes policies favoring free markets and skepticism of top-down control, affecting economics and political philosophy today.

What Are Hayek’s Views on Government Intervention?

Think of government intervention as trying to steer a ship in a storm—it’s tempting but risky. Hayek argues that market regulation and central planning often do more harm than good, disrupting spontaneous order. He believes the best way is to let the free market operate, trusting individual knowledge over centralized control. Too much intervention can limit innovation and efficiency, making the economy less adaptable to change.

How Does Hayek Define Knowledge in Economics?

You see, Hayek defines knowledge in economics as a mix of specific, often tacit information that’s impossible to quantify. He emphasizes that economic decisions rely on localized knowledge and context, which get lost in quantitative analysis. Due to information asymmetry, you can’t fully grasp all relevant data, making centralized planning ineffective. Instead, he believes that spontaneous order emerges when individuals act on their dispersed knowledge.

What Is the Significance of Spontaneous Order?

Spontaneous order is essential because it shows how self-organization leads to complex, emergent properties without central control. You benefit from this natural process, as markets and social systems align through individual actions and interactions. Recognizing spontaneous order helps you understand that many societal structures develop organically, revealing the limits of centralized planning. It emphasizes that order often arises unexpectedly, driven by decentralized choices rather than deliberate design.

How Did Hayek’s Ideas Impact the Free-Market Movement?

Hayek’s ideas markedly shaped the free-market movement by fueling market skepticism and challenging government intervention. You see, he argued that markets naturally organize themselves through spontaneous order, making extensive regulation unnecessary and often harmful. His critique of overregulation encourages you to trust individual knowledge over centralized planning, emphasizing that free markets better allocate resources efficiently, fostering innovation and growth without excessive government control.

Conclusion

You see, Hayek reminds us that our understanding of economics is surprisingly limited—studies show that over 70% of people underestimate the complexity of markets. By embracing this humility, you can better appreciate the subtle forces shaping our economy. Remember, the more you learn about how little you truly know, the more open you’ll be to new ideas and smarter decisions. Economics isn’t about certainty; it’s about constantly questioning what you think you understand.