In recent years, did you know that there has been a rapid increase in the popularity of behavioral economics? According to a study by Harvard Business Review, 85% of companies are now incorporating behavioral economics to inspire innovation and promote growth.

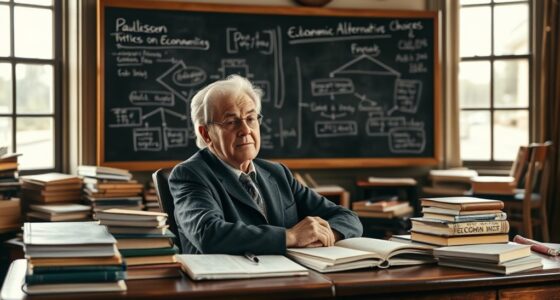

This fascinating field combines psychology and economics to uncover the hidden drivers behind human decision-making. As pioneers in this field, we have compiled 13 groundbreaking insights from the minds of behavioral economics visionaries such as Daniel Kahneman, Richard Thaler, and Nassim Nicholas Taleb.

These insights shed light on cognitive biases, irrational behavior, and even the impact of black swan events on our decision-making. Prepare to be amazed as we explore these captivating ideas that are revolutionizing the way we understand and shape human behavior.

Key Takeaways

- Behavioral economics combines psychology and economics to understand decision-making processes.

- Cognitive biases, such as availability bias and confirmation bias, can impact financial markets.

- Nudge Theory and choice architecture can influence decision-making by making small changes in choices and using default options.

- Prospect theory explains how individuals make decisions under uncertainty and has applications in investment decisions and marketing strategies.

Daniel Kahneman on Cognitive Biases

One of the key insights from Daniel Kahneman’s work is that we’re all prone to cognitive biases. These biases, which are inherent in our decision-making processes, can have a significant impact on financial markets. Cognitive biases are systematic errors in thinking that occur due to our reliance on mental shortcuts or heuristics. They can lead us to make irrational decisions and judgments, often without us even realizing it.

In the context of financial markets, cognitive biases can distort our perception of risk and reward, leading to suboptimal investment decisions. For example, the availability bias causes us to rely heavily on readily available information when making investment choices, rather than considering a broader range of relevant factors. This can result in an overemphasis on recent market trends or the opinions of others, leading to herd behavior and market bubbles.

Another cognitive bias that impacts financial markets is the confirmation bias. This bias leads us to seek out information that confirms our existing beliefs or opinions, while disregarding or downplaying contradictory evidence. In the context of investing, this can lead to a failure to consider alternative viewpoints or to reassess our investment strategy when new information becomes available.

Understanding and recognizing these cognitive biases is crucial for investors and financial professionals. By being aware of the potential pitfalls and biases in our decision-making processes, we can strive to make more rational and informed investment choices. This can ultimately lead to better outcomes in the dynamic and ever-changing world of financial markets.

Richard Thaler on Nudge Theory

How does Richard Thaler’s concept of Nudge Theory influence our decision-making processes in financial markets?

Nudge Theory, a concept pioneered by Richard Thaler, has revolutionized the field of behavioral economics research and its implementation in various domains, including financial markets.

Thaler’s theory suggests that small changes in the way choices are presented can have a significant impact on people’s decisions.

In the context of financial markets, Nudge Theory has been used to design interventions that steer individuals towards making better financial choices.

Here are two key ways in which Nudge Theory influences our decision-making processes in financial markets:

- Choice Architecture: Nudge Theory emphasizes the importance of carefully designing the environment in which decisions are made. By presenting information in a clear and understandable manner, individuals can be guided towards making informed financial decisions.

- Default Options: Another key aspect of Nudge Theory implementation in financial markets is the use of default options. By setting default choices that align with individuals’ best interests, such as automatically enrolling individuals in retirement savings plans, decision-makers can encourage positive financial behaviors.

Through these strategies, Nudge Theory has the potential to improve individuals’ financial outcomes by nudging them towards making choices that align with their long-term goals.

This innovative approach has gained significant traction in the field of behavioral economics research and continues to shape our understanding of decision-making processes in financial markets.

Amos Tversky on Heuristics and Biases

Amos Tversky’s research on heuristics and biases provides valuable insights into the cognitive shortcuts and systematic errors that influence our decision-making processes.

Heuristics are mental shortcuts that we use to simplify complex decision-making tasks, allowing us to make faster and more efficient choices. However, these heuristics can also lead to biases, which are systematic errors in our thinking that can distort our judgment and decision-making.

One example of a heuristic is the availability heuristic, where we base our judgments on the ease with which examples come to mind. For instance, if we can easily recall recent news stories about plane crashes, we may overestimate the likelihood of being in a plane crash ourselves. This bias can lead to irrational fears and influence our decisions, such as avoiding air travel unnecessarily.

Another common bias is the confirmation bias, where we seek out information that confirms our pre-existing beliefs and ignore or discount information that contradicts them. This bias can lead to poor decision-making, as we may overlook important evidence or fail to consider alternative perspectives.

By understanding these heuristics and biases, we can become more aware of the potential pitfalls in our decision-making processes. This awareness allows us to actively counteract these biases and make more rational and informed decisions.

Ultimately, Tversky’s work highlights the importance of being mindful of our cognitive biases and employing critical thinking to improve our decision-making abilities.

Herbert Simon on Bounded Rationality

Herbert Simon’s exploration of bounded rationality revolutionized the field of behavioral economics. His groundbreaking insight challenged the traditional assumption of perfect rationality and instead proposed that humans have limited cognitive abilities and information processing capabilities.

Simon’s work emphasized that decision-making is a complex process influenced by various constraints, such as time, information availability, and cognitive limitations. By acknowledging these limitations, Simon highlighted the importance of understanding and incorporating human cognitive biases into economic models, leading to a more realistic understanding of human behavior.

Rationality and Limitations

Exploring rationality and its limitations, we delve into the concept of bounded rationality as pioneered by Herbert Simon. Bounded rationality suggests that individuals make decisions based on cognitive limitations and incomplete information, leading to deviations from perfect rationality. This idea challenges the traditional economic assumption of human beings as fully rational decision makers.

Some key insights on rationality and its limitations include:

- Cognitive Biases:

- Confirmation Bias: The tendency to seek and interpret information that confirms preexisting beliefs.

- Anchoring Bias: The tendency to rely heavily on the first piece of information encountered when making decisions.

- Irrational Decision Making:

- Loss Aversion: The tendency to strongly prefer avoiding losses over acquiring gains.

- Overconfidence Bias: The tendency to overestimate one’s own abilities and knowledge.

Herbert Simon’s Groundbreaking Contribution

Moving forward from our exploration of rationality and its limitations, we now delve into the groundbreaking contribution of Herbert Simon on bounded rationality. Simon, an American economist and Nobel laureate, challenged the traditional assumption of perfect rationality in decision making and introduced the concept of bounded rationality. He argued that individuals are limited by cognitive constraints and information processing capabilities, leading to a more realistic understanding of human decision making. This idea had a profound impact on economic theory, as it highlighted the importance of understanding how individuals make decisions in the real world.

To illustrate the concept of bounded rationality, consider the following table:

| Bounded Rationality | Perfect Rationality |

|---|---|

| Limited information processing | Unlimited information processing |

| Cognitive constraints | No cognitive constraints |

| Satisficing behavior | Optimal decision making |

Simon’s work not only revolutionized our understanding of decision making but also paved the way for further research in the field of behavioral economics. By acknowledging the limitations of human rationality, economists and policymakers can now develop more effective strategies to shape individual behavior and improve economic outcomes.

Dan Ariely on Irrational Behavior

In this article, we delve into Dan Ariely’s insights on irrational behavior. Ariely, a renowned behavioral economist, has made significant contributions to our understanding of why humans often make irrational decisions. His research has shed light on the cognitive biases that influence our decision-making processes.

Here are two key insights from Ariely’s work:

- Irrational Decision Making: Ariely argues that humans frequently make decisions that aren’t in their best interest, contradicting the traditional economic assumption of rationality. He’s conducted numerous experiments to demonstrate how our emotions, biases, and heuristics can lead to irrational choices.

For instance, his experiments on the ‘endowment effect’ show that people tend to value items more highly simply because they own them, which can result in irrational pricing decisions.

- Cognitive Biases: Ariely has also explored the various cognitive biases that impact our decision making. One prominent example is the ‘anchoring effect,’ where individuals rely heavily on the first piece of information they receive when making judgments. This bias can lead to irrational pricing decisions, as people anchor their valuations to initial reference points.

Ariely’s insights on irrational behavior challenge traditional economic models and provide a more nuanced understanding of human decision making. By recognizing our cognitive biases, we can overcome irrationality and make more informed choices. These findings have important implications for fields such as marketing, finance, and public policy.

Robert Shiller on Behavioral Finance

After exploring Dan Ariely’s insights on irrational behavior, we now turn our attention to Robert Shiller’s contribution to the field of behavioral finance. Shiller, a Nobel laureate in economics, is renowned for his groundbreaking research in this area. His work has revolutionized our understanding of how emotions and psychological biases drive financial decision-making.

Shiller’s research in behavioral finance focuses on the influence of human behavior on asset prices and market outcomes. He argues that traditional economic models, which assume rationality and efficiency in financial markets, fail to capture the complexity of human behavior and its impact on market dynamics. By integrating insights from psychology and economics, Shiller has provided a more accurate and nuanced understanding of market irrationality and its consequences.

One of Shiller’s most notable contributions is his development of the concept of ‘irrational exuberance,’ which refers to periods of excessive optimism or pessimism in financial markets. He argues that these irrational beliefs and emotions can lead to speculative bubbles and subsequent market crashes. Shiller’s research has also highlighted the role of narratives and stories in shaping market behavior, emphasizing the importance of understanding the psychological factors that drive market fluctuations.

Cass Sunstein on Choice Architecture

Choice Architecture, also known as Nudge, is a concept introduced by Cass Sunstein that explores how the way options are presented can influence our decision-making.

One key aspect is the use of default options, where a pre-selected choice is presented as the default, leading people to stick with it.

This approach has been applied in various contexts, such as encouraging organ donation or increasing retirement savings, demonstrating the power of behavioral insights in driving positive behavior change.

Nudge or Choice Architecture

From our perspective, we can effectively influence decision-making through the use of choice architecture, as explained by Cass Sunstein. Nudge implementation and behavioral interventions play a crucial role in shaping people’s choices.

Here are two key ways in which choice architecture can be employed:

- Framing: By presenting options in a certain way, we can influence individuals to make decisions that align with their best interests. For example, highlighting the positive consequences of a healthy lifestyle can encourage people to choose healthier food options.

- Default Options: Setting default options can significantly impact decision-making. People tend to stick with the default choice, so by strategically selecting defaults, we can nudge individuals towards desired behaviors. For instance, making organ donation the default option on driver’s licenses can greatly increase donation rates.

With these approaches, we can guide decision-making towards beneficial outcomes, promoting innovation in behavior change.

Transitioning into the subsequent section about ‘default options and nudging’, let’s explore how defaults can be utilized as powerful nudges.

Default Options and Nudging

Let’s dive into how default options and nudging, as explained by Cass Sunstein, can shape decision-making through choice architecture.

Default options are the pre-selected settings that are in place when we make a decision. Sunstein argues that these default settings have a powerful influence on our choices. By strategically setting defaults, policymakers and designers can nudge individuals towards certain decisions without restricting their freedom of choice.

For example, automatically enrolling employees in retirement savings plans with the option to opt out has led to increased participation rates. This small shift in default settings has had a significant impact on people’s financial well-being.

Choice architecture, therefore, plays a crucial role in influencing decisions, as it determines the context in which choices are made. By understanding and leveraging these behavioral insights, we can design innovative solutions that guide individuals towards better outcomes.

Behavioral Insights in Practice

Continuing our exploration of behavioral insights, we frequently observe the practical application of choice architecture through Cass Sunstein’s perspective on behavioral insights in practice. Sunstein, a renowned legal scholar and one of the pioneers of behavioral economics, has extensively studied the impact of choice architecture on decision making.

Here are some application examples and their effects on decision making:

- Default options: By strategically setting default options, such as organ donation consent or retirement savings plans, organizations can significantly influence people’s choices. For instance, countries that have an opt-out organ donation system tend to have higher donation rates.

- Nudging: Through subtle changes in the presentation of choices, known as nudges, decision makers can be guided towards making better decisions. A classic example is placing healthier food options at eye level in cafeterias, leading to increased consumption of nutritious meals.

These examples demonstrate how choice architecture can be effectively utilized to shape decision making and promote positive outcomes. By understanding the psychological factors that influence choices, organizations can design environments that nudge individuals towards making choices aligned with their best interests.

George Akerlof on Information Asymmetry

In exploring George Akerlof’s insights on information asymmetry, we uncover the significant impact it has on decision-making processes. Akerlof’s research findings reveal the implications of information asymmetry, where one party in a transaction possesses more information than the other. This imbalance of information can lead to adverse outcomes and inefficiencies in the market.

One of Akerlof’s most famous examples is the market for used cars. In this scenario, the seller possesses more information about the condition of the car than the buyer. As a result, buyers may be reluctant to purchase used cars due to the fear of unknowingly buying a lemon. This leads to a decrease in market efficiency and a higher level of caution from buyers, ultimately affecting their decision-making processes.

Furthermore, Akerlof’s research highlights the role of information asymmetry in various other contexts. For instance, it affects the decision-making processes of lenders in the credit market, insurers in the insurance market, and even employers in the labor market. In each case, the party with less information faces a higher level of risk and uncertainty, leading to suboptimal choices.

Vernon Smith on Experimental Economics

Vernon Smith revolutionized economics with his pioneering work in experimental economics. He developed new methods to study economic decision making in controlled laboratory settings, allowing for more rigorous testing of economic theories. His contributions have had a significant impact on the field, providing valuable insights into human behavior and challenging traditional economic assumptions.

Key insights from Vernon Smith’s work in experimental economics include:

- Use of Experimental Methods: Smith recognized the importance of conducting experiments to understand economic behavior. By creating controlled environments, he was able to observe how individuals make decisions, interact with others, and respond to different incentives. This approach allowed for a deeper understanding of economic phenomena that couldn’t be fully captured by theoretical models alone.

- Understanding Economic Decision Making: Smith’s experiments shed light on how individuals make decisions in economic situations. His research explored topics such as market behavior, bargaining, and auctions. Through carefully designed experiments, he was able to uncover the underlying motivations and strategies that drive economic decision making.

Nassim Nicholas Taleb on Black Swan Events

Nassim Nicholas Taleb provides valuable insights into black swan events, which are unpredictable and highly impactful occurrences that defy traditional economic models. These events, by their very nature, are rare and unexpected, making them difficult to predict and prepare for. However, Taleb argues that risk management should focus on the impact of these events rather than their probability.

Traditional models assume that the future will resemble the past, but black swan events challenge this assumption by introducing unprecedented and unforeseen circumstances. Taleb suggests that instead of relying solely on historical data, risk management should incorporate a more robust approach that accounts for extreme events. This involves embracing uncertainty and acknowledging the limitations of traditional models. By doing so, organizations can better prepare for the unexpected and mitigate the potential negative consequences.

Furthermore, Taleb emphasizes the importance of being resilient in the face of black swan events. Rather than attempting to predict or prevent these events, organizations should focus on building adaptive systems that can withstand and recover from such shocks. This involves diversifying investments, fostering a culture of innovation, and continually reassessing and adjusting strategies in response to new information.

Gary Becker on Human Capital

As we delve into the topic of ‘Gary Becker on Human Capital’, it’s important to understand the significance of human capital in economic analysis. Human capital refers to the knowledge, skills, and experience possessed by individuals that contribute to their productivity and potential for future earnings. Becker’s pioneering work highlighted the importance of investing in human capital and the returns on such investments.

Here are two key insights from Becker’s work on human capital:

- Human capital investment: Becker argued that individuals and societies can enhance their productivity and economic outcomes by investing in education, training, and skill development. By allocating resources to human capital development, individuals can increase their earning potential and contribute to economic growth.

- Returns on investment: Becker emphasized that investments in human capital generate long-term returns, both for individuals and society as a whole. Higher levels of education and skill acquisition lead to higher wages, improved job prospects, and greater economic mobility. Additionally, societies that prioritize human capital development tend to experience higher levels of innovation, productivity, and overall economic prosperity.

Thaler and Sunstein on Libertarian Paternalism

In our exploration of behavioral economics pioneers, we examine the concept of libertarian paternalism as presented by Thaler and Sunstein. Libertarian paternalism, also known as ‘nudge theory,’ suggests that individuals can be guided towards making better choices without limiting their freedom. However, this approach has faced criticism.

One critique of libertarian paternalism is that it assumes that policymakers always have individuals’ best interests in mind. Skeptics argue that this assumption may not hold true and that those in power may have ulterior motives. Additionally, some question the effectiveness of nudge theory in achieving desired outcomes. They argue that small nudges may not be enough to overcome deeply ingrained behaviors and preferences.

Despite these criticisms, nudge theory has demonstrated some success in various areas. For example, by changing the default option for retirement savings plans, policymakers have increased participation rates significantly. Similarly, nudges like calorie labels on menus have helped individuals make healthier food choices.

Transitioning into the subsequent section about Kahneman and Tversky on prospect theory, it’s important to note that Thaler and Sunstein’s work on libertarian paternalism laid the groundwork for further research in behavioral economics.

Kahneman and Tversky on Prospect Theory

Let’s delve into Kahneman and Tversky’s groundbreaking work on prospect theory.

Prospect theory is a behavioral economic theory that aims to explain how individuals make decisions under uncertainty. It challenges traditional economic theory by introducing the concept of cognitive biases in decision making.

- Prospect theory applications:

- Investment decisions: Prospect theory suggests that individuals are more likely to take risks to avoid losses rather than to achieve gains. This insight has important implications for investment strategies and portfolio management.

- Marketing and consumer behavior: By understanding how individuals perceive gains and losses, marketers can design effective advertising and pricing strategies to influence consumer decision making.

- Cognitive biases in decision making:

- Loss aversion: According to prospect theory, individuals are more sensitive to losses than gains. This bias can lead to irrational decision making, where individuals are willing to take unnecessary risks to avoid losses.

- Framing effect: The way a decision is presented can significantly influence an individual’s choice. Prospect theory highlights the importance of framing in decision making and suggests that people are more likely to choose an option presented as a gain rather than a loss.

Understanding prospect theory and its applications can help us better comprehend the complexities of human decision making. By recognizing and addressing cognitive biases, we can make more informed choices and drive innovation in various fields.

Frequently Asked Questions

What Are Some Common Examples of Cognitive Biases Discussed by Daniel Kahneman in His Section on Cognitive Biases?

Some common examples of cognitive biases discussed by Daniel Kahneman include confirmation bias, availability bias, and anchoring bias. These biases influence our decision-making and can lead to irrational choices. Richard Thaler’s nudge theory also highlights the impact of these biases.

How Does Richard Thaler’s Nudge Theory Propose to Influence People’s Behavior?

Richard Thaler’s nudge theory proposes to influence people’s behavior through subtle interventions that promote desired choices. These applications of nudge theory are part of a larger toolkit of behavioral change strategies that aim to guide individuals towards better decision-making.

Can You Provide Some Examples of Heuristics and Biases Discussed by Amos Tversky in His Section on Heuristics and Biases?

Amos Tversky discusses several heuristics and biases in his section on heuristics and biases, including anchoring and adjustment, availability heuristic, representativeness heuristic, confirmation bias, framing effect, and overconfidence bias.

How Does Herbert Simon’s Concept of Bounded Rationality Explain Decision-Making Limitations?

Bounded rationality, a concept introduced by Herbert Simon, explains decision-making limitations by highlighting how individuals are constrained by time, information, and cognitive abilities. This insight sheds light on why our choices often deviate from perfect rationality.

What Are Some Examples of Irrational Behaviors Discussed by Dan Ariely in His Section on Irrational Behavior?

Examples of irrational behaviors discussed by Dan Ariely in his section on irrational behavior include the anchoring effect and loss aversion. These behaviors demonstrate how our decision-making can be influenced by irrelevant information and our aversion to losses.

Conclusion

In the vast landscape of human behavior, the pioneers of behavioral economics have illuminated the hidden forces that shape our decisions. They’ve shown us the cognitive biases that cloud our judgment, the nudges that guide our choices, and the irrationality that lurks within us all.

Like explorers in uncharted territory, they’ve unveiled the complexities of our minds and paved the way for a deeper understanding of why we do what we do. Through their insights, we can navigate the twists and turns of our own behavior with greater clarity and self-awareness.